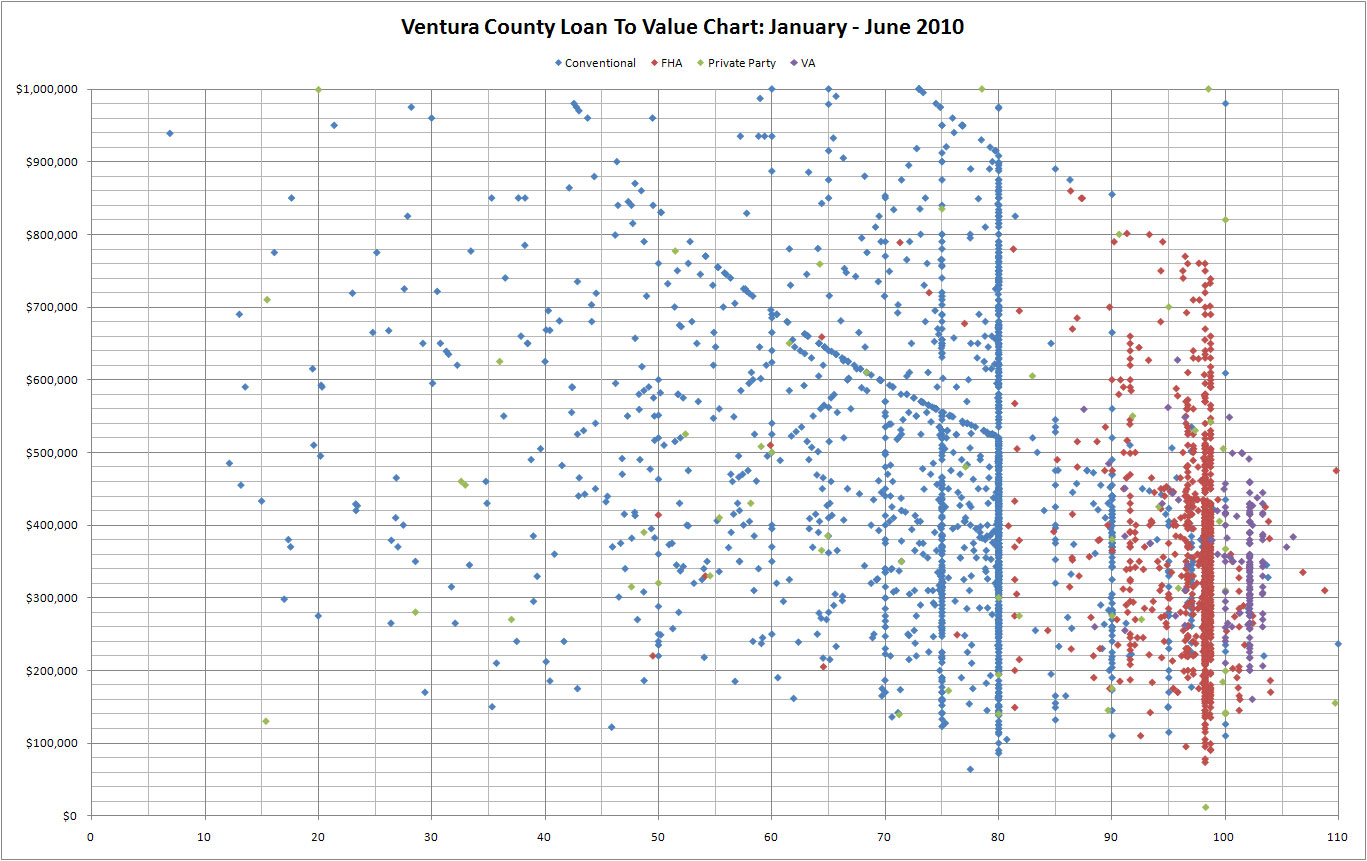

loan to value purchase

|

Photo: Odilon Dimier | Getty Images A Loan To Value Ratio Defined High loan to value, California hard money loans How to Calculate a New or Used Car Loan Value - CarsDirect |

|

Photo: Spencer Platt | Digital Planet Design Loan to Value Ratio How to Calculate Loan to Value LTV Ratio - Real Estate Business ... Loan-To-Value Ratio (LTV Ratio) Definition | Investopedia |

|

Photo: Tetra Images | Getty Images LTV Eligibility Matrix 08-21-12 - eFannieMae.com Understanding Loan To Value |

|

Photo: Spencer Platt | Getty Images Loan to Value Calculator for Calculating LTV Ratio Expanded LTV and TLTV Ratios - Freddie Mac How to Calculate Your Loan-to-Value Ratio | eHow.com |

|

Photo: Peter Cade | Getty Images What is Loan to Value? What Are the Loan to Value Ratios When Buying a House? | Home ... What Is the Down Payment? - The Mortgage Professor |

|

Photo: Tony Anderson | Getty Images Down Payment Options and LTV Ratio Information - Mortgage-info.us Refinance - Purchase Differences Firstmark Credit Union - Conventional Mortgage Loan Section A. Calculating Maximum Mortgage Amounts on Purchase ... |

|

Photo: Getty Images Department of Veterans Affairs (VA) Mortgage - Freddie Mac Mortgage loan - Wikipedia, the free encyclopedia Home Buying: Can PMI be based on assessed value to loan amount ... |

|

Photo: iStock Up to 102% LTV / .3% ANNUAL FEE ... - USDA Rural Development Commercial Loans Underwriting, LTV, DSC, - Commercial Real ... New FHA Loan-to-Value and Credit Score Requirements | LoanSafe |

|

Photo: PM Images | Getty Images New Car Loan FAQ - New Auto Loan Questions | Capital One What Does "Resulting LTV on Mortgage Loans" Mean? | Home ... HUD Homeownership Center Reference Guide Refinances OCC: Commercial Real Estate (CRE) |

|

Photo: Ryan McVay | Photodisc | Getty Images How LTV and CLTV Will Affect Your New Home Loan - Loan Page Determining Loan-To-Value LTV - Home Loan Help Center |

|

Photo: Stockbyte | Getty Images SC, $390000, , 60% LTV, Purchase, nodoc - Mortgage Grapevine What Is Private Mortgage Insurance (PMI) - How to Avoid Paying It What Is Loan-to-Value on a Mortgage? - Budgeting Money |

|

Photo: Tony Pagliaroli | Getty Images Interagency Guidance on High LTV Residential Real Estate Lending Understanding Loan to Value Ratio (LTV Ratio) The Truth About Private Mortgage Insurance & How To Cancel It |

|

Photo: Indeed | Photodisc | Getty Images Loan scenario: , $50000+, 640+, 65 ARV% LTV, Purchase - Mortgage ... Loan to Value Ratio | Mortgage LTV | The Truth About Mortgage.com How do I calculate my loan-to-value ratio (LTV)?: Mortgage Center ... |