Public Types |

Public Member Functions |

Protected Member Functions |

Protected Attributes |

List of all members

BinomialLossModel< LLM > Class Template Reference

#include <ql/experimental/credit/binomiallossmodel.hpp>

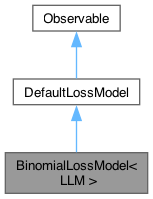

Inheritance diagram for BinomialLossModel< LLM >:

Public Types | |

| typedef LLM::copulaType | copulaType |

Public Member Functions | |

| BinomialLossModel (ext::shared_ptr< LLM > copula) | |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

Protected Member Functions | |

| std::vector< Real > | expectedDistribution (const Date &date) const |

| std::vector< Real > | lossPoints (const Date &) const |

| attainable loss points this model provides | |

| std::map< Real, Probability > | lossDistribution (const Date &d) const override |

| Returns the cumulative full loss distribution. | |

| Real | percentile (const Date &d, Real percentile) const override |

| Loss level for this percentile. | |

| Real | expectedShortfall (const Date &d, Real percentile) const override |

| Expected shortfall given a default loss percentile. | |

| Real | expectedTrancheLoss (const Date &d) const override |

| Real | averageLoss (const Date &, const std::vector< Real > &reminingNots, const std::vector< Real > &) const |

| Average loss per credit. | |

| Real | condTrancheLoss (const Date &, const std::vector< Real > &lossVals, const std::vector< Real > &bsktNots, const std::vector< Probability > &uncondDefProbs, const std::vector< Real > &) const |

| std::vector< Real > | expConditionalLgd (const Date &d, const std::vector< Real > &mktFactors) const |

| std::vector< Real > | lossProbability (const Date &date, const std::vector< Real > &bsktNots, const std::vector< Real > &uncondDefProbInv, const std::vector< Real > &mktFactor) const |

| Loss probability density conditional on the market factor value. | |

| virtual Probability | probOverLoss (const Date &d, Real lossFraction) const |

| virtual std::vector< Real > | splitVaRLevel (const Date &d, Real loss) const |

| Associated VaR fraction to each counterparty. | |

| virtual std::vector< Real > | splitESFLevel (const Date &d, Real loss) const |

| Associated ESF fraction to each counterparty. | |

| virtual Real | densityTrancheLoss (const Date &d, Real lossFraction) const |

| Probability density of a given loss fraction of the basket notional. | |

| virtual std::vector< Probability > | probsBeingNthEvent (Size n, const Date &d) const |

| virtual Real | defaultCorrelation (const Date &d, Size iName, Size jName) const |

| Pearsons' default probability correlation. | |

| virtual Probability | probAtLeastNEvents (Size n, const Date &d) const |

| virtual Real | expectedRecovery (const Date &, Size iName, const DefaultProbKey &) const |

Protected Attributes | |

| const ext::shared_ptr< LLM > | copula_ |

| Real | attachAmount_ |

| Real | detachAmount_ |

| Protected Attributes inherited from DefaultLossModel | |

| RelinkableHandle< Basket > | basket_ |

Detailed Description

template<class LLM>

class QuantLib::BinomialLossModel< LLM >

class QuantLib::BinomialLossModel< LLM >

Binomial Defaultable Basket Loss Model

- Models the portfolio loss distribution by approximatting it to an adjusted binomial. Fits the two moments of the loss distribution through an adapted binomial approximation. This simple model allows for portfolio inhomogeneity with no excesive cost over the LHP.

- See:

- Approximating Independent Loss Distributions with an Adjusted Binomial Distribution , Dominic O'Kane, 2007 EDHEC RISK AND ASSET MANAGEMENT RESEARCH CENTRE

- Modelling single name and multi-name credit derivatives Chapter 18.5.2, Dominic O'Kane, Wiley Finance, 2008

- The version presented here is adaptated to the multifactorial case by computing a conditional binomial approximation; notice that the Binomial is stable. This way the model can be used also in risk management models rather than only in pricing. The copula is also left undefined/arbitrary.

- LLM: Loss Latent Model template parameter able to model default and loss.

- The model is allowed and arbitrary copula, although initially designed for a Gaussian setup. If these exotic versions were not allowed the template parameter can then be dropped but the use of random recoveries should be added in some other way.

Member Function Documentation

◆ expectedDistribution()

Returns the probability of the default loss values given by the method lossPoints.

◆ lossDistribution()

template<class LLM>

|

overrideprotectedvirtual |

Returns the cumulative full loss distribution.

Reimplemented from DefaultLossModel.

◆ percentile()

template<class LLM>

|

overrideprotectedvirtual |

Loss level for this percentile.

Reimplemented from DefaultLossModel.

◆ expectedShortfall()

template<class LLM>

|

overrideprotectedvirtual |

Expected shortfall given a default loss percentile.

Reimplemented from DefaultLossModel.

◆ expectedTrancheLoss()

Reimplemented from DefaultLossModel.

Generated by Doxygen 1.15.0