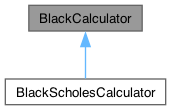

Black 1976 calculator class. More...

#include <ql/pricingengines/blackcalculator.hpp>

Public Member Functions | |

| BlackCalculator (const ext::shared_ptr< StrikedTypePayoff > &payoff, Real forward, Real stdDev, Real discount=1.0) | |

| BlackCalculator (Option::Type optionType, Real strike, Real forward, Real stdDev, Real discount=1.0) | |

| Real | value () const |

| Real | deltaForward () const |

| virtual Real | delta (Real spot) const |

| Real | elasticityForward () const |

| virtual Real | elasticity (Real spot) const |

| Real | gammaForward () const |

| virtual Real | gamma (Real spot) const |

| virtual Real | theta (Real spot, Time maturity) const |

| virtual Real | thetaPerDay (Real spot, Time maturity) const |

| Real | vega (Time maturity) const |

| Real | rho (Time maturity) const |

| Real | dividendRho (Time maturity) const |

| Real | itmCashProbability () const |

| Real | itmAssetProbability () const |

| Real | strikeSensitivity () const |

| Real | strikeGamma () const |

| Real | vanna (Real spot, Time maturity) const |

| Real | volga (Time maturity) const |

| Real | alpha () const |

| Real | beta () const |

Protected Member Functions | |

| void | initialize (const ext::shared_ptr< StrikedTypePayoff > &p) |

Protected Attributes | |

| Real | strike_ |

| Real | forward_ |

| Real | stdDev_ |

| Real | discount_ |

| Real | variance_ |

| Real | d1_ |

| Real | d2_ |

| Real | alpha_ |

| Real | beta_ |

| Real | DalphaDd1_ |

| Real | DbetaDd2_ |

| Real | n_d1_ |

| Real | cum_d1_ |

| Real | n_d2_ |

| Real | cum_d2_ |

| Real | x_ |

| Real | DxDs_ |

| Real | DxDstrike_ |

Detailed Description

Black 1976 calculator class.

- Examples

- DiscreteHedging.cpp.

Member Function Documentation

◆ deltaForward()

| Real deltaForward | ( | ) | const |

Sensitivity to change in the underlying forward price.

◆ delta()

Sensitivity to change in the underlying spot price.

Reimplemented in BlackScholesCalculator.

◆ elasticityForward()

| Real elasticityForward | ( | ) | const |

Sensitivity in percent to a percent change in the underlying forward price.

◆ elasticity()

Sensitivity in percent to a percent change in the underlying spot price.

Reimplemented in BlackScholesCalculator.

◆ gammaForward()

| Real gammaForward | ( | ) | const |

Second order derivative with respect to change in the underlying forward price.

◆ gamma()

Second order derivative with respect to change in the underlying spot price.

Reimplemented in BlackScholesCalculator.

◆ theta()

Sensitivity to time to maturity.

Reimplemented in BlackScholesCalculator.

◆ thetaPerDay()

Sensitivity to time to maturity per day, assuming 365 day per year.

Reimplemented in BlackScholesCalculator.

◆ vega()

Sensitivity to volatility.

- Examples

- DiscreteHedging.cpp.

◆ rho()

◆ dividendRho()

◆ itmCashProbability()

| Real itmCashProbability | ( | ) | const |

Probability of being in the money in the bond martingale measure, i.e. N(d2). It is a risk-neutral probability, not the real world one.

◆ itmAssetProbability()

| Real itmAssetProbability | ( | ) | const |

Probability of being in the money in the asset martingale measure, i.e. N(d1). It is a risk-neutral probability, not the real world one.

◆ strikeSensitivity()

| Real strikeSensitivity | ( | ) | const |

Sensitivity to strike.

◆ strikeGamma()

| Real strikeGamma | ( | ) | const |

gamma w.r.t. strike.

◆ vanna()

◆ volga()

Generated by Doxygen 1.15.0