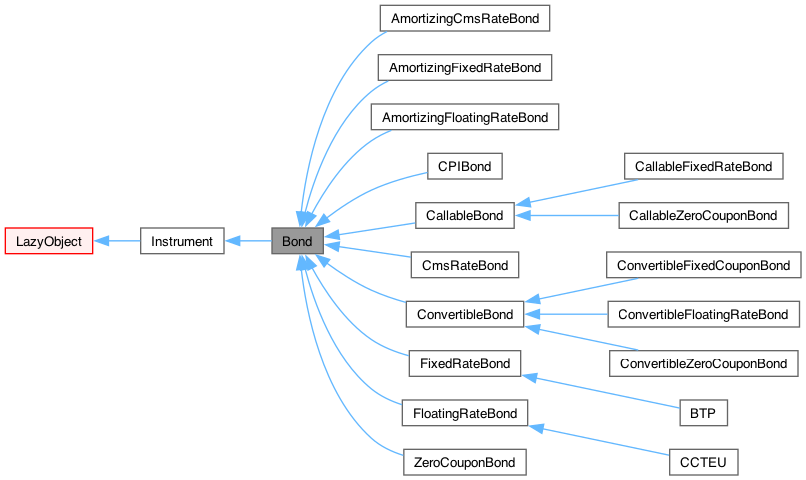

Base bond class. More...

#include <ql/instruments/bond.hpp>

Classes | |

| class | Price |

| Bond price information. More... | |

Public Member Functions | |

| Bond (Natural settlementDays, Calendar calendar, const Date &issueDate=Date(), const Leg &coupons=Leg()) | |

| constructor for amortizing or non-amortizing bonds. | |

| Bond (Natural settlementDays, Calendar calendar, Real faceAmount, const Date &maturityDate, const Date &issueDate=Date(), const Leg &cashflows=Leg()) | |

| old constructor for non amortizing bonds. | |

Instrument interface | |

| bool | isExpired () const override |

| returns whether the instrument might have value greater than zero. | |

Observable interface | |

| void | deepUpdate () override |

Inspectors | |

| Natural | settlementDays () const |

| const Calendar & | calendar () const |

| const std::vector< Real > & | notionals () const |

| virtual Real | notional (Date d=Date()) const |

| const Leg & | cashflows () const |

| const Leg & | redemptions () const |

| const ext::shared_ptr< CashFlow > & | redemption () const |

| Date | startDate () const |

| Date | maturityDate () const |

| Date | issueDate () const |

| bool | isTradable (Date d=Date()) const |

| Date | settlementDate (Date d=Date()) const |

| Public Member Functions inherited from Instrument | |

| Real | NPV () const |

| returns the net present value of the instrument. | |

| Real | errorEstimate () const |

| returns the error estimate on the NPV when available. | |

| const Date & | valuationDate () const |

| returns the date the net present value refers to. | |

| const ext::shared_ptr< PricingEngine > & | pricingEngine () const |

| template<typename T> | |

| T | result (const std::string &tag) const |

| returns any additional result returned by the pricing engine. | |

| const std::map< std::string, ext::any > & | additionalResults () const |

| returns all additional result returned by the pricing engine. | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &) |

| set the pricing engine to be used. | |

| Public Member Functions inherited from LazyObject | |

| void | update () override |

| bool | isCalculated () const |

| void | setCalculated (bool c) const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

Calculations | |

| Natural | settlementDays_ |

| Calendar | calendar_ |

| std::vector< Date > | notionalSchedule_ |

| std::vector< Real > | notionals_ |

| Leg | cashflows_ |

| Leg | redemptions_ |

| Date | maturityDate_ |

| Date | issueDate_ |

| Real | settlementValue_ |

| Real | cleanPrice () const |

| theoretical clean price | |

| Real | dirtyPrice () const |

| theoretical dirty price | |

| Real | settlementValue () const |

| theoretical settlement value | |

| Rate | yield (const DayCounter &dc, Compounding comp, Frequency freq, Real accuracy=1.0e-8, Size maxEvaluations=100, Real guess=0.05, Bond::Price::Type priceType=Bond::Price::Clean) const |

| theoretical bond yield | |

| Real | cleanPrice (Rate yield, const DayCounter &dc, Compounding comp, Frequency freq, Date settlementDate=Date()) const |

| clean price given a yield and settlement date | |

| Real | dirtyPrice (Rate yield, const DayCounter &dc, Compounding comp, Frequency freq, Date settlementDate=Date()) const |

| dirty price given a yield and settlement date | |

| Real | settlementValue (Real cleanPrice) const |

| settlement value as a function of the clean price | |

| Rate | yield (Bond::Price price, const DayCounter &dc, Compounding comp, Frequency freq, Date settlementDate=Date(), Real accuracy=1.0e-8, Size maxEvaluations=100, Real guess=0.05) const |

| yield given a price and settlement date | |

| virtual Real | accruedAmount (Date d=Date()) const |

| accrued amount at a given date | |

| virtual Rate | nextCouponRate (Date d=Date()) const |

| Rate | previousCouponRate (Date d=Date()) const |

| Previous coupon already paid at a given date. | |

| Date | nextCashFlowDate (Date d=Date()) const |

| Date | previousCashFlowDate (Date d=Date()) const |

| void | setupExpired () const override |

| void | setupArguments (PricingEngine::arguments *) const override |

| void | fetchResults (const PricingEngine::results *) const override |

| void | addRedemptionsToCashflows (const std::vector< Real > &redemptions=std::vector< Real >()) |

| void | setSingleRedemption (Real notional, Real redemption, const Date &date) |

| void | setSingleRedemption (Real notional, const ext::shared_ptr< CashFlow > &redemption) |

| void | calculateNotionalsFromCashflows () |

Additional Inherited Members | |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| Protected Member Functions inherited from Instrument | |

| void | calculate () const override |

| void | performCalculations () const override |

| Protected Attributes inherited from Instrument | |

| Real | NPV_ |

| Real | errorEstimate_ |

| Date | valuationDate_ |

| std::map< std::string, ext::any > | additionalResults_ |

| ext::shared_ptr< PricingEngine > | engine_ |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

Detailed Description

Base bond class.

Derived classes must fill the uninitialized data members.

- Warning

- Most methods assume that the cash flows are stored sorted by date, the redemption(s) being after any cash flow at the same date. In particular, if there's one single redemption, it must be the last cash flow,

- Tests

- price/yield calculations are cross-checked for consistency.

- price/yield calculations are checked against known good values.

- Examples

- FittedBondCurve.cpp.

Constructor & Destructor Documentation

◆ Bond() [1/2]

| Bond | ( | Natural | settlementDays, |

| Calendar | calendar, | ||

| const Date & | issueDate = Date(), | ||

| const Leg & | coupons = Leg() ) |

constructor for amortizing or non-amortizing bonds.

Redemptions and maturity are calculated from the coupon data, if available. Therefore, redemptions must not be included in the passed cash flows.

◆ Bond() [2/2]

| Bond | ( | Natural | settlementDays, |

| Calendar | calendar, | ||

| Real | faceAmount, | ||

| const Date & | maturityDate, | ||

| const Date & | issueDate = Date(), | ||

| const Leg & | cashflows = Leg() ) |

old constructor for non amortizing bonds.

- Warning

- The last passed cash flow must be the bond redemption. No other cash flow can have a date later than the redemption date.

Member Function Documentation

◆ isExpired()

|

overridevirtual |

returns whether the instrument might have value greater than zero.

Implements Instrument.

◆ deepUpdate()

|

overridevirtual |

This method allows to explicitly update the instance itself and nested observers. If notifications are disabled a call to this method ensures an update of such nested observers. It should be implemented in derived classes whenever applicable

Reimplemented from Observer.

◆ cashflows()

| const Leg & cashflows | ( | ) | const |

- Note

- returns all the cashflows, including the redemptions.

- Examples

- Bonds.cpp.

◆ redemptions()

| const Leg & redemptions | ( | ) | const |

returns just the redemption flows (not interest payments)

◆ redemption()

| const ext::shared_ptr< CashFlow > & redemption | ( | ) | const |

returns the redemption, if only one is defined

◆ cleanPrice() [1/2]

| Real cleanPrice | ( | ) | const |

theoretical clean price

The default bond settlement is used for calculation.

- Warning

- the theoretical price calculated from a flat term structure might differ slightly from the price calculated from the corresponding yield by means of the other overload of this function. If the price from a constant yield is desired, it is advisable to use such other overload.

- Examples

- Bonds.cpp.

◆ dirtyPrice() [1/2]

| Real dirtyPrice | ( | ) | const |

theoretical dirty price

The default bond settlement is used for calculation.

- Warning

- the theoretical price calculated from a flat term structure might differ slightly from the price calculated from the corresponding yield by means of the other overload of this function. If the price from a constant yield is desired, it is advisable to use such other overload.

- Examples

- Bonds.cpp.

◆ settlementValue() [1/2]

| Real settlementValue | ( | ) | const |

theoretical settlement value

The default bond settlement date is used for calculation.

◆ yield() [1/2]

| Rate yield | ( | const DayCounter & | dc, |

| Compounding | comp, | ||

| Frequency | freq, | ||

| Real | accuracy = 1.0e-8, | ||

| Size | maxEvaluations = 100, | ||

| Real | guess = 0.05, | ||

| Bond::Price::Type | priceType = Bond::Price::Clean ) const |

theoretical bond yield

The default bond settlement and theoretical price are used for calculation.

- Examples

- Bonds.cpp.

◆ cleanPrice() [2/2]

| Real cleanPrice | ( | Rate | yield, |

| const DayCounter & | dc, | ||

| Compounding | comp, | ||

| Frequency | freq, | ||

| Date | settlementDate = Date() ) const |

clean price given a yield and settlement date

The default bond settlement is used if no date is given.

◆ dirtyPrice() [2/2]

| Real dirtyPrice | ( | Rate | yield, |

| const DayCounter & | dc, | ||

| Compounding | comp, | ||

| Frequency | freq, | ||

| Date | settlementDate = Date() ) const |

dirty price given a yield and settlement date

The default bond settlement is used if no date is given.

◆ settlementValue() [2/2]

settlement value as a function of the clean price

The default bond settlement date is used for calculation.

◆ yield() [2/2]

| Rate yield | ( | Bond::Price | price, |

| const DayCounter & | dc, | ||

| Compounding | comp, | ||

| Frequency | freq, | ||

| Date | settlementDate = Date(), | ||

| Real | accuracy = 1.0e-8, | ||

| Size | maxEvaluations = 100, | ||

| Real | guess = 0.05 ) const |

yield given a price and settlement date

The default bond settlement is used if no date is given.

◆ accruedAmount()

◆ nextCouponRate()

Expected next coupon: depending on (the bond and) the given date the coupon can be historic, deterministic or expected in a stochastic sense. When the bond settlement date is used the coupon is the already-fixed not-yet-paid one.

The current bond settlement is used if no date is given.

- Examples

- Bonds.cpp.

◆ previousCouponRate()

Previous coupon already paid at a given date.

Expected previous coupon: depending on (the bond and) the given date the coupon can be historic, deterministic or expected in a stochastic sense. When the bond settlement date is used the coupon is the last paid one.

The current bond settlement is used if no date is given.

- Examples

- Bonds.cpp.

◆ setupExpired()

|

overrideprotectedvirtual |

This method must leave the instrument in a consistent state when the expiration condition is met.

Reimplemented from Instrument.

◆ setupArguments()

|

overrideprotectedvirtual |

When a derived argument structure is defined for an instrument, this method should be overridden to fill it. This is mandatory in case a pricing engine is used.

Reimplemented from Instrument.

Reimplemented in CallableBond, and ConvertibleBond.

◆ fetchResults()

|

overrideprotectedvirtual |

When a derived result structure is defined for an instrument, this method should be overridden to read from it. This is mandatory in case a pricing engine is used.

Reimplemented from Instrument.

◆ addRedemptionsToCashflows()

|

protected |

This method can be called by derived classes in order to build redemption payments from the existing cash flows. It must be called after setting up the cashflows_ vector and will fill the notionalSchedule_, notionals_, and redemptions_ data members.

If given, the elements of the redemptions vector will multiply the amount of the redemption cash flow. The elements will be taken in base 100, i.e., a redemption equal to 100 does not modify the amount.

- Precondition

- The cashflows_ vector must contain at least one coupon and must be sorted by date.

◆ setSingleRedemption() [1/2]

This method can be called by derived classes in order to build a bond with a single redemption payment. It will fill the notionalSchedule_, notionals_, and redemptions_ data members.

◆ setSingleRedemption() [2/2]

|

protected |

This method can be called by derived classes in order to build a bond with a single redemption payment. It will fill the notionalSchedule_, notionals_, and redemptions_ data members.

◆ calculateNotionalsFromCashflows()

|

protected |

used internally to collect notional information from the coupons. It should not be called by derived classes, unless they already provide redemption cash flows (in which case they must set up the redemptions_ data member independently). It will fill the notionalSchedule_ and notionals_ data members.

Generated by Doxygen 1.15.0