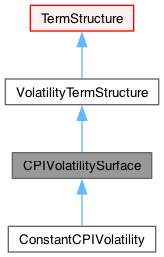

zero inflation (i.e. CPI/RPI/HICP/etc.) volatility structures More...

#include <ql/termstructures/volatility/inflation/cpivolatilitystructure.hpp>

Public Member Functions | |

| CPIVolatilitySurface (Natural settlementDays, const Calendar &, BusinessDayConvention bdc, const DayCounter &dc, const Period &observationLag, Frequency frequency, bool indexIsInterpolated) | |

Volatility | |

| Volatility | volatility (const Date &maturityDate, Rate strike, const Period &obsLag=Period(-1, Days), bool extrapolate=false) const |

| Returns the volatility for a given maturity date and strike rate. | |

| Volatility | volatility (const Period &optionTenor, Rate strike, const Period &obsLag=Period(-1, Days), bool extrapolate=false) const |

| returns the volatility for a given option tenor and strike rate | |

| Volatility | volatility (Time time, Rate strike) const |

| virtual Volatility | totalVariance (const Date &exerciseDate, Rate strike, const Period &obsLag=Period(-1, Days), bool extrapolate=false) const |

| virtual Volatility | totalVariance (const Period &optionTenor, Rate strike, const Period &obsLag=Period(-1, Days), bool extrapolate=false) const |

Inspectors | |

| virtual Period | observationLag () const |

| virtual Frequency | frequency () const |

| virtual bool | indexIsInterpolated () const |

| virtual Date | baseDate () const |

| virtual Time | timeFromBase (const Date &date, const Period &obsLag=Period(-1, Days)) const |

| base date will be in the past because of observation lag | |

| virtual Volatility | baseLevel () const |

| VolatilityTermStructure (BusinessDayConvention bdc, const DayCounter &dc=DayCounter()) | |

| VolatilityTermStructure (const Date &referenceDate, const Calendar &cal, BusinessDayConvention bdc, const DayCounter &dc=DayCounter()) | |

| initialize with a fixed reference date | |

| VolatilityTermStructure (Natural settlementDays, const Calendar &cal, BusinessDayConvention bdc, const DayCounter &dc=DayCounter()) | |

| calculate the reference date based on the global evaluation date | |

| virtual BusinessDayConvention | businessDayConvention () const |

| the business day convention used in tenor to date conversion | |

| Date | optionDateFromTenor (const Period &) const |

| period/date conversion | |

| Public Member Functions inherited from TermStructure | |

| TermStructure (DayCounter dc=DayCounter()) | |

| default constructor | |

| TermStructure (const Date &referenceDate, Calendar calendar=Calendar(), DayCounter dc=DayCounter()) | |

| initialize with a fixed reference date | |

| TermStructure (Natural settlementDays, Calendar, DayCounter dc=DayCounter()) | |

| calculate the reference date based on the global evaluation date | |

| virtual DayCounter | dayCounter () const |

| the day counter used for date/time conversion | |

| Time | timeFromReference (const Date &date) const |

| date/time conversion | |

| virtual Date | maxDate () const =0 |

| the latest date for which the curve can return values | |

| virtual Time | maxTime () const |

| the latest time for which the curve can return values | |

| virtual const Date & | referenceDate () const |

| the date at which discount = 1.0 and/or variance = 0.0 | |

| virtual Calendar | calendar () const |

| the calendar used for reference and/or option date calculation | |

| virtual Natural | settlementDays () const |

| the settlementDays used for reference date calculation | |

| void | update () override |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Extrapolator | |

| void | enableExtrapolation (bool b=true) |

| enable extrapolation in subsequent calls | |

| void | disableExtrapolation (bool b=true) |

| disable extrapolation in subsequent calls | |

| bool | allowsExtrapolation () const |

| tells whether extrapolation is enabled | |

Limits | |

| Volatility | baseLevel_ |

| Period | observationLag_ |

| Frequency | frequency_ |

| bool | indexIsInterpolated_ |

| Real | minStrike () const override=0 |

| the minimum strike for which the term structure can return vols | |

| Real | maxStrike () const override=0 |

| the maximum strike for which the term structure can return vols | |

| virtual void | checkRange (const Date &, Rate strike, bool extrapolate) const |

| virtual void | checkRange (Time, Rate strike, bool extrapolate) const |

| virtual Volatility | volatilityImpl (Time length, Rate strike) const =0 |

Additional Inherited Members | |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| void | checkStrike (Rate strike, bool extrapolate) const |

| strike-range check | |

| void | checkRange (const Date &d, bool extrapolate) const |

| date-range check | |

| void | checkRange (Time t, bool extrapolate) const |

| time-range check | |

| bool | moving_ = false |

| bool | updated_ = true |

| Calendar | calendar_ |

Detailed Description

zero inflation (i.e. CPI/RPI/HICP/etc.) volatility structures

Abstract interface. CPI volatility is always with respect to some base date. Also deal with lagged observations of an index with a (usually different) availability lag.

Constructor & Destructor Documentation

◆ CPIVolatilitySurface()

| CPIVolatilitySurface | ( | Natural | settlementDays, |

| const Calendar & | , | ||

| BusinessDayConvention | bdc, | ||

| const DayCounter & | dc, | ||

| const Period & | observationLag, | ||

| Frequency | frequency, | ||

| bool | indexIsInterpolated ) |

calculates the reference date based on the global evaluation date.

Member Function Documentation

◆ volatility() [1/2]

| Volatility volatility | ( | const Date & | maturityDate, |

| Rate | strike, | ||

| const Period & | obsLag = Period(-1, Days), | ||

| bool | extrapolate = false ) const |

Returns the volatility for a given maturity date and strike rate.

by default, inflation is observed with the lag of the term structure.

Because inflation is highly linked to dates (for interpolation, periods, etc) time-based overload of the methods are not provided.

◆ volatility() [2/2]

| Volatility volatility | ( | Time | time, |

| Rate | strike ) const |

Returns the volatility for a given time and strike rate. No adjustments due to lags and interpolation are applied to the input time.

◆ totalVariance() [1/2]

|

virtual |

Returns the total integrated variance for a given exercise date and strike rate.

Total integrated variance is useful because it scales out t for the optionlet pricing formulae. Note that it is called "total" because the surface does not know whether it represents Black, Bachelier or Displaced Diffusion variance. These are virtual so alternate connections between const vol and total var are possible.

◆ totalVariance() [2/2]

|

virtual |

returns the total integrated variance for a given option tenor and strike rate.

◆ observationLag()

|

virtual |

The term structure observes with a lag that is usually different from the availability lag of the index. An inflation rate is given, by default, for the maturity requested assuming this lag.

◆ minStrike()

|

overridepure virtual |

the minimum strike for which the term structure can return vols

Implements VolatilityTermStructure.

Implemented in ConstantCPIVolatility.

◆ maxStrike()

|

overridepure virtual |

the maximum strike for which the term structure can return vols

Implements VolatilityTermStructure.

Implemented in ConstantCPIVolatility.

◆ volatilityImpl()

|

protectedpure virtual |

Implements the actual volatility surface calculation in derived classes e.g. bilinear interpolation. N.B. does not derive the surface.

Generated by Doxygen 1.15.0