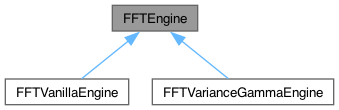

FFTEngine Class Referenceabstract

Base class for FFT pricing engines for European vanilla options. More...

#include <ql/experimental/variancegamma/fftengine.hpp>

Inheritance diagram for FFTEngine:

Public Member Functions | |

| FFTEngine (ext::shared_ptr< StochasticProcess1D > process, Real logStrikeSpacing) | |

| void | calculate () const override |

| void | update () override |

| void | precalculate (const std::vector< ext::shared_ptr< Instrument > > &optionList) |

| virtual std::unique_ptr< FFTEngine > | clone () const =0 |

Protected Member Functions | |

| virtual void | precalculateExpiry (Date d)=0 |

| virtual std::complex< Real > | complexFourierTransform (std::complex< Real > u) const =0 |

| virtual Real | discountFactor (Date d) const =0 |

| virtual Real | dividendYield (Date d) const =0 |

| void | calculateUncached (const ext::shared_ptr< StrikedTypePayoff > &payoff, const ext::shared_ptr< Exercise > &exercise) const |

Protected Attributes | |

| ext::shared_ptr< StochasticProcess1D > | process_ |

| Real | lambda_ |

Detailed Description

Base class for FFT pricing engines for European vanilla options.

The FFT engine calculates the values of all options with the same expiry at the same time. For that reason it is very inefficient to price options individually. When using this engine you should collect all the options you wish to price in a list and call the engine's precalculate method before calling the NPV method of the option.

References: Carr, P. and D. B. Madan (1998), "Option Valuation using the fast Fourier transform," Journal of Computational Finance, 2, 61-73.

Generated by Doxygen 1.15.0