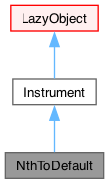

N-th to default swap. More...

#include <ql/experimental/credit/nthtodefault.hpp>

Classes | |

| class | engine |

| NTD base engine. More... | |

Public Member Functions | |

| NthToDefault (const ext::shared_ptr< Basket > &basket, Size n, Protection::Side side, Schedule premiumSchedule, Rate upfrontRate, Rate premiumRate, const DayCounter &dayCounter, Real nominal, bool settlePremiumAccrual) | |

| This product is 'digital'; the basket might be tranched but this is. | |

| bool | isExpired () const override |

| returns whether the instrument might have value greater than zero. | |

| Rate | premium () const |

| Real | nominal () const |

| DayCounter | dayCounter () const |

| Protection::Side | side () const |

| Size | rank () const |

| Size | basketSize () const |

| const Date & | maturity () const |

| const ext::shared_ptr< Basket > & | basket () const |

| Rate | fairPremium () const |

| Real | premiumLegNPV () const |

| Real | protectionLegNPV () const |

| Real | errorEstimate () const |

| void | setupArguments (PricingEngine::arguments *) const override |

| void | fetchResults (const PricingEngine::results *) const override |

| Public Member Functions inherited from Instrument | |

| Real | NPV () const |

| returns the net present value of the instrument. | |

| Real | errorEstimate () const |

| returns the error estimate on the NPV when available. | |

| const Date & | valuationDate () const |

| returns the date the net present value refers to. | |

| const ext::shared_ptr< PricingEngine > & | pricingEngine () const |

| template<typename T> | |

| T | result (const std::string &tag) const |

| returns any additional result returned by the pricing engine. | |

| const std::map< std::string, ext::any > & | additionalResults () const |

| returns all additional result returned by the pricing engine. | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &) |

| set the pricing engine to be used. | |

| Public Member Functions inherited from LazyObject | |

| void | update () override |

| bool | isCalculated () const |

| void | setCalculated (bool c) const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

Additional Inherited Members | |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| Protected Member Functions inherited from Instrument | |

| void | calculate () const override |

| void | performCalculations () const override |

| Protected Attributes inherited from Instrument | |

| Real | NPV_ |

| Real | errorEstimate_ |

| Date | valuationDate_ |

| std::map< std::string, ext::any > | additionalResults_ |

| ext::shared_ptr< PricingEngine > | engine_ |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

Detailed Description

N-th to default swap.

A NTD instrument exchanges protection against the nth default in a basket of underlying credits for premium payments based on the protected notional amount.

The pricing is analogous to the pricing of a CDS instrument which represents protection against default of a single underlying credit. The only difference is the calculation of the probability of default. In the CDS case, it is the probabilty of single name default; in the NTD case the probability of at least N defaults in the portfolio of underlying credits.

This probability is computed using the algorithm in John Hull and Alan White, "Valuation of a CDO and nth to default CDS without Monte Carlo simulation", Journal of Derivatives 12, 2, 2004.

The algorithm allows for varying probability of default across the basket. Otherwise, for identical probabilities of default, the probability of n defaults is given by the binomial distribution.

Default correlation is modeled using a one-factor Gaussian copula approach.

The class is tested against data in Hull-White (see reference above.)

Member Function Documentation

◆ isExpired()

|

overridevirtual |

returns whether the instrument might have value greater than zero.

Implements Instrument.

◆ setupArguments()

|

overridevirtual |

When a derived argument structure is defined for an instrument, this method should be overridden to fill it. This is mandatory in case a pricing engine is used.

Reimplemented from Instrument.

◆ fetchResults()

|

overridevirtual |

When a derived result structure is defined for an instrument, this method should be overridden to read from it. This is mandatory in case a pricing engine is used.

Reimplemented from Instrument.

Generated by Doxygen 1.15.0