#include <ql/experimental/credit/randomdefaultlatentmodel.hpp>

Protected Member Functions | |

| RandomLM (Size numFactors, Size numLMVars, copulaPolicy copula, Size nSims, BigNatural seed) | |

| void | update () override |

| void | performCalculations () const override |

| void | performSimulations () const |

| const std::vector< simEvent< derivedRandomLM< copulaPolicy, USNG > > > & | getSim (const Size iSim) const |

| Real | getEventRecovery (const simEvent< derivedRandomLM< copulaPolicy, USNG > > &evt) const |

| virtual void | calculate () const |

| virtual Probability | probOverLoss (const Date &d, Real lossFraction) const |

| virtual std::vector< Real > | splitESFLevel (const Date &d, Real loss) const |

| Associated ESF fraction to each counterparty. | |

| virtual Real | densityTrancheLoss (const Date &d, Real lossFraction) const |

| Probability density of a given loss fraction of the basket notional. | |

| virtual Real | expectedRecovery (const Date &, Size iName, const DefaultProbKey &) const |

Statistics, DefaultLossModel interface. | |

| const Size | numFactors_ |

| const Size | numLMVars_ |

| const Size | nSims_ |

| std::vector< std::vector< simEvent< derivedRandomLM< copulaPolicy, USNG > > > > | simsBuffer_ |

| copulaPolicy | copula_ |

| ext::shared_ptr< copulaRNG_type > | copulasRng_ |

| static const Size | maxHorizon_ = 4050 |

| Probability | probAtLeastNEvents (Size n, const Date &d) const override |

| std::vector< Probability > | probsBeingNthEvent (Size n, const Date &d) const override |

| Real | defaultCorrelation (const Date &d, Size iName, Size jName) const override |

| Pearsons' default probability correlation. | |

| Real | expectedTrancheLoss (const Date &d) const override |

| virtual std::pair< Real, Real > | expectedTrancheLossInterval (const Date &d, Probability confidencePerc) const |

| std::map< Real, Probability > | lossDistribution (const Date &d) const override |

| Full loss distribution. | |

| virtual Histogram | computeHistogram (const Date &d) const |

| Real | expectedShortfall (const Date &d, Real percent) const override |

| Expected shortfall given a default loss percentile. | |

| Real | percentile (const Date &d, Real percentile) const override |

| Value at Risk given a default loss percentile. | |

| virtual std::tuple< Real, Real, Real > | percentileAndInterval (const Date &d, Real percentile) const |

| std::vector< Real > | splitVaRLevel (const Date &date, Real loss) const override |

| virtual std::vector< std::vector< Real > > | splitVaRAndError (const Date &date, Real loss, Probability confInterval) const |

Additional Inherited Members | |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| Public Member Functions inherited from LazyObject | |

| bool | isCalculated () const |

| void | setCalculated (bool c) const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

| Protected Attributes inherited from DefaultLossModel | |

| RelinkableHandle< Basket > | basket_ |

Detailed Description

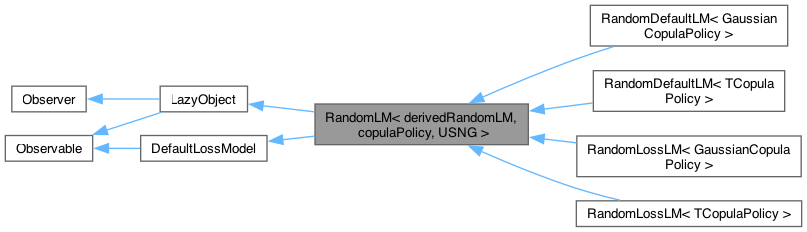

class QuantLib::RandomLM< derivedRandomLM, copulaPolicy, USNG >

Base class for latent model monte carlo simulation. Independent of the copula type and the generator. Generates the factors and variable samples and determines event threshold but it is not responsible for actual event specification; thats the derived classes responsibility according to what they model. Derived classes need mainly to implement nextSample (Worker::nextSample in the multithreaded version) to compute the simulation event generated, if any, from the latent variables sample. They also have the accompanying event trait to specify.

Member Function Documentation

◆ update()

|

overrideprotectedvirtual |

This method must be implemented in derived classes. An instance of Observer does not call this method directly: instead, it will be called by the observables the instance registered with when they need to notify any changes.

Reimplemented from LazyObject.

◆ performCalculations()

|

overrideprotectedvirtual |

This method must implement any calculations which must be (re)done in order to calculate the desired results.

Implements LazyObject.

◆ probAtLeastNEvents()

|

overrideprotectedvirtual |

Returns the probaility of having a given or larger number of defaults in the basket portfolio at a given time.

Reimplemented from DefaultLossModel.

◆ probsBeingNthEvent()

|

overrideprotectedvirtual |

Order of results refers to the simulated (super)pool not the basket's pool. Notice that this statistic suffers from heavy dispersion. To see techniques to improve it (not implemented here) see: Joshi, M., D. Kainth. 2004. Rapid and accurate development of prices and Greeks for nth to default credit swaps in the Li model. Quantitative Finance, Vol. 4. Institute of Physics Publishing, London, UK, 266-275 and: Chen, Z., Glasserman, P. 'Fast pricing of basket default swaps' in Operations Research Vol. 56, No. 2, March/April 2008, pp. 286-303

Reimplemented from DefaultLossModel.

◆ defaultCorrelation()

|

overrideprotectedvirtual |

Pearsons' default probability correlation.

Reimplemented from DefaultLossModel.

◆ expectedTrancheLoss()

|

overrideprotectedvirtual |

Reimplemented from DefaultLossModel.

◆ lossDistribution()

|

overrideprotectedvirtual |

Full loss distribution.

Reimplemented from DefaultLossModel.

◆ expectedShortfall()

|

overrideprotectedvirtual |

Expected shortfall given a default loss percentile.

Reimplemented from DefaultLossModel.

◆ percentile()

|

overrideprotectedvirtual |

Value at Risk given a default loss percentile.

Reimplemented from DefaultLossModel.

◆ percentileAndInterval()

|

protectedvirtual |

Returns the VaR value for a given percentile and the 95 confidence interval of that value.

◆ splitVaRLevel()

|

overrideprotectedvirtual |

Distributes the total VaR amount along the portfolio counterparties. The passed loss amount is in loss units.

Reimplemented from DefaultLossModel.

◆ splitVaRAndError()

|

protectedvirtual |

Distributes the total VaR amount along the portfolio counterparties.

Provides confidence interval for split so that portfolio optimization can be performed outside those limits.

The passed loss amount is in loss units.

Generated by Doxygen 1.15.0