SuperFundPayoff Class Reference

Binary supershare and superfund payoffs. More...

#include <ql/instruments/payoffs.hpp>

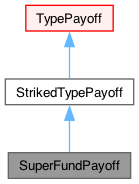

Inheritance diagram for SuperFundPayoff:

Public Member Functions | |

| SuperFundPayoff (Real strike, Real secondStrike) | |

| std::string | description () const override |

| Real | strike () const |

| Public Member Functions inherited from TypePayoff | |

| Option::Type | optionType () const |

| std::string | description () const override |

| Public Member Functions inherited from Payoff | |

Payoff interface | |

| Real | secondStrike_ |

| std::string | name () const override |

| Real | operator() (Real price) const override |

| void | accept (AcyclicVisitor &) override |

| Real | secondStrike () const |

Additional Inherited Members | |

| StrikedTypePayoff (Option::Type type, Real strike) | |

| TypePayoff (Option::Type type) | |

| Real | strike_ |

| Option::Type | type_ |

Detailed Description

Binary supershare and superfund payoffs.

Binary superfund payoff

Superfund sometimes also called "supershare", which can lead to ambiguity; within QuantLib the terms supershare and superfund are used consistently according to the definitions in Bloomberg OVX function's help pages.

This payoff is equivalent to being (1/lowerstrike) a) long (short) an AssetOrNothing Call (Put) at the lower strike and b) short (long) an AssetOrNothing Call (Put) at the higher strike

Member Function Documentation

◆ name()

|

overridevirtual |

◆ operator()()

◆ accept()

|

overridevirtual |

Reimplemented from Payoff.

Generated by Doxygen 1.15.0