VanillaOption Class Reference

Vanilla option (no discrete dividends, no barriers) on a single asset. More...

#include <ql/instruments/vanillaoption.hpp>

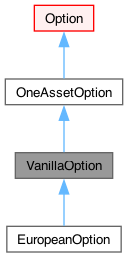

Inheritance diagram for VanillaOption:

Public Member Functions | |

| VanillaOption (const ext::shared_ptr< StrikedTypePayoff > &, const ext::shared_ptr< Exercise > &) | |

| Volatility | impliedVolatility (Real price, const ext::shared_ptr< GeneralizedBlackScholesProcess > &process, Real accuracy=1.0e-4, Size maxEvaluations=100, Volatility minVol=1.0e-7, Volatility maxVol=4.0) const |

| Volatility | impliedVolatility (Real price, const ext::shared_ptr< GeneralizedBlackScholesProcess > &process, const DividendSchedule ÷nds, Real accuracy=1.0e-4, Size maxEvaluations=100, Volatility minVol=1.0e-7, Volatility maxVol=4.0) const |

| Public Member Functions inherited from OneAssetOption | |

| OneAssetOption (const ext::shared_ptr< Payoff > &, const ext::shared_ptr< Exercise > &) | |

| bool | isExpired () const override |

| returns whether the instrument might have value greater than zero. | |

| Real | delta () const |

| Real | deltaForward () const |

| Real | elasticity () const |

| Real | gamma () const |

| Real | theta () const |

| Real | thetaPerDay () const |

| Real | vega () const |

| Real | rho () const |

| Real | dividendRho () const |

| Real | strikeSensitivity () const |

| Real | itmCashProbability () const |

| void | fetchResults (const PricingEngine::results *) const override |

| Public Member Functions inherited from Option | |

| Option (ext::shared_ptr< Payoff > payoff, ext::shared_ptr< Exercise > exercise) | |

| void | setupArguments (PricingEngine::arguments *) const override |

| ext::shared_ptr< Payoff > | payoff () const |

| ext::shared_ptr< Exercise > | exercise () const |

| Public Member Functions inherited from Instrument | |

| Real | NPV () const |

| returns the net present value of the instrument. | |

| Real | errorEstimate () const |

| returns the error estimate on the NPV when available. | |

| const Date & | valuationDate () const |

| returns the date the net present value refers to. | |

| const ext::shared_ptr< PricingEngine > & | pricingEngine () const |

| template<typename T> | |

| T | result (const std::string &tag) const |

| returns any additional result returned by the pricing engine. | |

| const std::map< std::string, ext::any > & | additionalResults () const |

| returns all additional result returned by the pricing engine. | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &) |

| set the pricing engine to be used. | |

| Public Member Functions inherited from LazyObject | |

| void | update () override |

| bool | isCalculated () const |

| void | setCalculated (bool c) const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

Additional Inherited Members | |

| Public Types inherited from Option | |

| enum | Type { Put = -1 , Call = 1 } |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| void | setupExpired () const override |

| Protected Member Functions inherited from Instrument | |

| void | calculate () const override |

| void | performCalculations () const override |

| Real | delta_ |

| Real | deltaForward_ |

| Real | elasticity_ |

| Real | gamma_ |

| Real | theta_ |

| Real | thetaPerDay_ |

| Real | vega_ |

| Real | rho_ |

| Real | dividendRho_ |

| Real | strikeSensitivity_ |

| Real | itmCashProbability_ |

| Protected Attributes inherited from Option | |

| ext::shared_ptr< Payoff > | payoff_ |

| ext::shared_ptr< Exercise > | exercise_ |

| Protected Attributes inherited from Instrument | |

| Real | NPV_ |

| Real | errorEstimate_ |

| Date | valuationDate_ |

| std::map< std::string, ext::any > | additionalResults_ |

| ext::shared_ptr< PricingEngine > | engine_ |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

| Related Symbols inherited from Option | |

| std::ostream & | operator<< (std::ostream &, Option::Type) |

Detailed Description

Vanilla option (no discrete dividends, no barriers) on a single asset.

Member Function Documentation

◆ impliedVolatility()

| Volatility impliedVolatility | ( | Real | price, |

| const ext::shared_ptr< GeneralizedBlackScholesProcess > & | process, | ||

| Real | accuracy = 1.0e-4, | ||

| Size | maxEvaluations = 100, | ||

| Volatility | minVol = 1.0e-7, | ||

| Volatility | maxVol = 4.0 ) const |

- Warning

- currently, this method returns the Black-Scholes implied volatility using analytic formulas for European options and a finite-difference method for American and Bermudan options. It will give unconsistent results if the pricing was performed with any other methods (such as jump-diffusion models.)

- Warning

- options with a gamma that changes sign (e.g., binary options) have values that are not monotonic in the volatility. In these cases, the calculation can fail and the result (if any) is almost meaningless. Another possible source of failure is to have a target value that is not attainable with any volatility, e.g., a target value lower than the intrinsic value in the case of American options.

Generated by Doxygen 1.15.0