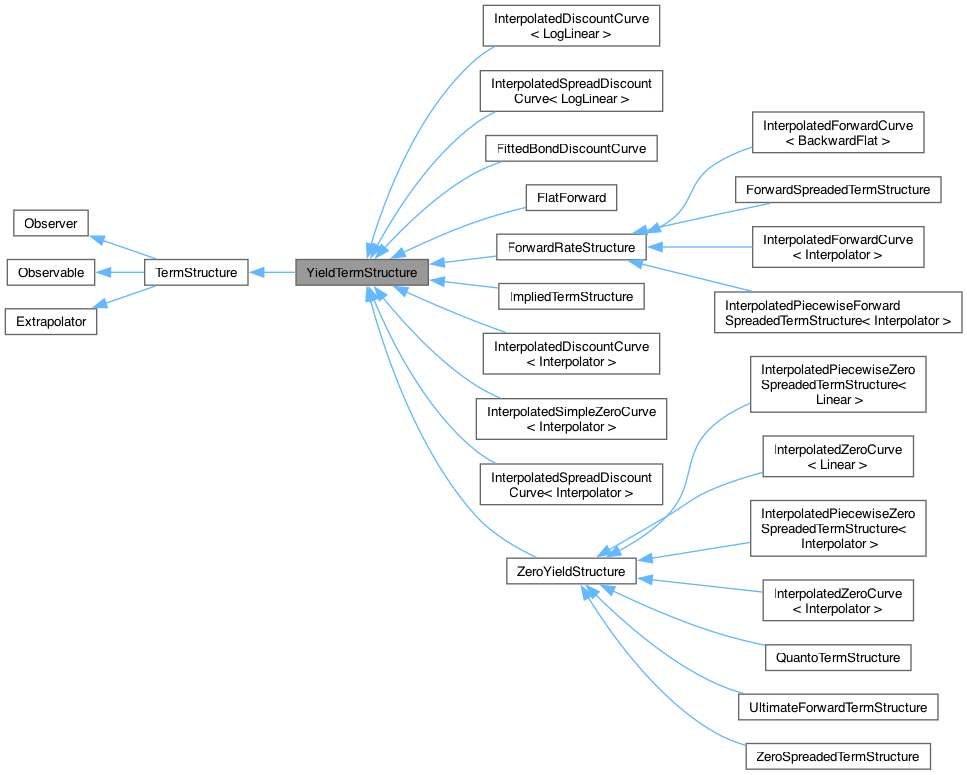

Interest-rate term structure. More...

#include <ql/termstructures/yieldtermstructure.hpp>

Public Member Functions | |

Constructors | |

See the TermStructure documentation for issues regarding constructors. | |

| YieldTermStructure (const DayCounter &dc=DayCounter()) | |

| YieldTermStructure (const Date &referenceDate, const Calendar &cal=Calendar(), const DayCounter &dc=DayCounter(), std::vector< Handle< Quote > > jumps={}, const std::vector< Date > &jumpDates={}) | |

| YieldTermStructure (Natural settlementDays, const Calendar &cal, const DayCounter &dc=DayCounter(), std::vector< Handle< Quote > > jumps={}, const std::vector< Date > &jumpDates={}) | |

Discount factors | |

These methods return the discount factor from a given date or time to the reference date. In the latter case, the time is calculated as a fraction of year from the reference date. | |

| DiscountFactor | discount (const Date &d, bool extrapolate=false) const |

| DiscountFactor | discount (Time t, bool extrapolate=false) const |

Zero-yield rates | |

These methods return the implied zero-yield rate for a given date or time. In the former case, the time is calculated as a fraction of year from the reference date. | |

| InterestRate | zeroRate (const Date &d, const DayCounter &resultDayCounter, Compounding comp, Frequency freq=Annual, bool extrapolate=false) const |

| InterestRate | zeroRate (Time t, Compounding comp, Frequency freq=Annual, bool extrapolate=false) const |

Forward rates | |

These methods returns the forward interest rate between two dates or times. In the former case, times are calculated as fractions of year from the reference date. If both dates (times) are equal the instantaneous forward rate is returned. | |

| InterestRate | forwardRate (const Date &d1, const Date &d2, const DayCounter &resultDayCounter, Compounding comp, Frequency freq=Annual, bool extrapolate=false) const |

| InterestRate | forwardRate (const Date &d, const Period &p, const DayCounter &resultDayCounter, Compounding comp, Frequency freq=Annual, bool extrapolate=false) const |

| InterestRate | forwardRate (Time t1, Time t2, Compounding comp, Frequency freq=Annual, bool extrapolate=false) const |

Jump inspectors | |

| const std::vector< Date > & | jumpDates () const |

| const std::vector< Time > & | jumpTimes () const |

Observer interface | |

| void | update () override |

| Public Member Functions inherited from TermStructure | |

| TermStructure (DayCounter dc=DayCounter()) | |

| default constructor | |

| TermStructure (const Date &referenceDate, Calendar calendar=Calendar(), DayCounter dc=DayCounter()) | |

| initialize with a fixed reference date | |

| TermStructure (Natural settlementDays, Calendar, DayCounter dc=DayCounter()) | |

| calculate the reference date based on the global evaluation date | |

| virtual DayCounter | dayCounter () const |

| the day counter used for date/time conversion | |

| Time | timeFromReference (const Date &date) const |

| date/time conversion | |

| virtual Date | maxDate () const =0 |

| the latest date for which the curve can return values | |

| virtual Time | maxTime () const |

| the latest time for which the curve can return values | |

| virtual const Date & | referenceDate () const |

| the date at which discount = 1.0 and/or variance = 0.0 | |

| virtual Calendar | calendar () const |

| the calendar used for reference and/or option date calculation | |

| virtual Natural | settlementDays () const |

| the settlementDays used for reference date calculation | |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Extrapolator | |

| void | enableExtrapolation (bool b=true) |

| enable extrapolation in subsequent calls | |

| void | disableExtrapolation (bool b=true) |

| disable extrapolation in subsequent calls | |

| bool | allowsExtrapolation () const |

| tells whether extrapolation is enabled | |

Calculations | |

This method must be implemented in derived classes to perform the actual calculations. When it is called, range check has already been performed; therefore, it must assume that extrapolation is required. | |

| virtual DiscountFactor | discountImpl (Time) const =0 |

| discount factor calculation | |

Additional Inherited Members | |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| void | checkRange (const Date &d, bool extrapolate) const |

| date-range check | |

| void | checkRange (Time t, bool extrapolate) const |

| time-range check | |

| bool | moving_ = false |

| bool | updated_ = true |

| Calendar | calendar_ |

Detailed Description

Interest-rate term structure.

This abstract class defines the interface of concrete interest rate structures which will be derived from this one.

- Tests

- observability against evaluation date changes is checked.

- Examples

- FittedBondCurve.cpp.

Member Function Documentation

◆ discount()

| DiscountFactor discount | ( | Time | t, |

| bool | extrapolate = false ) const |

The same day-counting rule used by the term structure should be used for calculating the passed time t.

◆ zeroRate() [1/2]

| InterestRate zeroRate | ( | const Date & | d, |

| const DayCounter & | resultDayCounter, | ||

| Compounding | comp, | ||

| Frequency | freq = Annual, | ||

| bool | extrapolate = false ) const |

The resulting interest rate has the required daycounting rule.

◆ zeroRate() [2/2]

| InterestRate zeroRate | ( | Time | t, |

| Compounding | comp, | ||

| Frequency | freq = Annual, | ||

| bool | extrapolate = false ) const |

The resulting interest rate has the same day-counting rule used by the term structure. The same rule should be used for calculating the passed time t.

◆ forwardRate() [1/3]

| InterestRate forwardRate | ( | const Date & | d1, |

| const Date & | d2, | ||

| const DayCounter & | resultDayCounter, | ||

| Compounding | comp, | ||

| Frequency | freq = Annual, | ||

| bool | extrapolate = false ) const |

The resulting interest rate has the required day-counting rule.

◆ forwardRate() [2/3]

| InterestRate forwardRate | ( | const Date & | d, |

| const Period & | p, | ||

| const DayCounter & | resultDayCounter, | ||

| Compounding | comp, | ||

| Frequency | freq = Annual, | ||

| bool | extrapolate = false ) const |

The resulting interest rate has the required day-counting rule.

- Warning

- dates are not adjusted for holidays

◆ forwardRate() [3/3]

| InterestRate forwardRate | ( | Time | t1, |

| Time | t2, | ||

| Compounding | comp, | ||

| Frequency | freq = Annual, | ||

| bool | extrapolate = false ) const |

The resulting interest rate has the same day-counting rule used by the term structure. The same rule should be used for calculating the passed times t1 and t2.

◆ update()

|

overridevirtual |

This method must be implemented in derived classes. An instance of Observer does not call this method directly: instead, it will be called by the observables the instance registered with when they need to notify any changes.

Reimplemented from TermStructure.

Reimplemented in ZeroSpreadedTermStructure.

◆ discountImpl()

|

protectedpure virtual |

discount factor calculation

Implemented in ForwardRateStructure, ImpliedTermStructure, InterpolatedDiscountCurve< Interpolator >, InterpolatedDiscountCurve< LogLinear >, InterpolatedSimpleZeroCurve< Interpolator >, InterpolatedSpreadDiscountCurve< Interpolator >, InterpolatedSpreadDiscountCurve< LogLinear >, and ZeroYieldStructure.

Generated by Doxygen 1.15.0