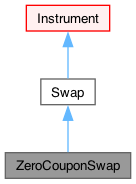

Zero-coupon interest rate swap. More...

#include <ql/instruments/zerocouponswap.hpp>

Public Member Functions | |

| ZeroCouponSwap (Type type, Real baseNominal, const Date &startDate, const Date &maturityDate, Real fixedPayment, ext::shared_ptr< IborIndex > iborIndex, const Calendar &paymentCalendar, BusinessDayConvention paymentConvention=Following, Natural paymentDelay=0) | |

| ZeroCouponSwap (Type type, Real baseNominal, const Date &startDate, const Date &maturityDate, Rate fixedRate, const DayCounter &fixedDayCounter, ext::shared_ptr< IborIndex > iborIndex, const Calendar &paymentCalendar, BusinessDayConvention paymentConvention=Following, Natural paymentDelay=0) | |

Inspectors | |

| Type | type () const |

| "payer" or "receiver" refer to the fixed leg. | |

| Real | baseNominal () const |

| Date | startDate () const override |

| Date | maturityDate () const override |

| const ext::shared_ptr< IborIndex > & | iborIndex () const |

| const Leg & | fixedLeg () const |

| just one cashflow in each leg | |

| const Leg & | floatingLeg () const |

| just one cashflow in each leg | |

| Real | fixedPayment () const |

| Public Member Functions inherited from Swap | |

| void | deepUpdate () override |

| Size | numberOfLegs () const |

| const std::vector< Leg > & | legs () const |

| Real | legBPS (Size j) const |

| Real | legNPV (Size j) const |

| DiscountFactor | startDiscounts (Size j) const |

| DiscountFactor | endDiscounts (Size j) const |

| DiscountFactor | npvDateDiscount () const |

| const Leg & | leg (Size j) const |

| bool | payer (Size j) const |

| bool | isExpired () const override |

| returns whether the instrument might have value greater than zero. | |

| void | setupArguments (PricingEngine::arguments *) const override |

| void | fetchResults (const PricingEngine::results *) const override |

| Swap (const Leg &firstLeg, const Leg &secondLeg) | |

| Swap (const std::vector< Leg > &legs, const std::vector< bool > &payer) | |

| Public Member Functions inherited from Instrument | |

| Real | NPV () const |

| returns the net present value of the instrument. | |

| Real | errorEstimate () const |

| returns the error estimate on the NPV when available. | |

| const Date & | valuationDate () const |

| returns the date the net present value refers to. | |

| const ext::shared_ptr< PricingEngine > & | pricingEngine () const |

| template<typename T> | |

| T | result (const std::string &tag) const |

| returns any additional result returned by the pricing engine. | |

| const std::map< std::string, ext::any > & | additionalResults () const |

| returns all additional result returned by the pricing engine. | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &) |

| set the pricing engine to be used. | |

| Public Member Functions inherited from LazyObject | |

| void | update () override |

| bool | isCalculated () const |

| void | setCalculated (bool c) const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

Results | |

| Real | fixedLegNPV () const |

| Real | floatingLegNPV () const |

| Real | fairFixedPayment () const |

| Rate | fairFixedRate (const DayCounter &dayCounter) const |

Additional Inherited Members | |

| Public Types inherited from Swap | |

| enum | Type { Receiver = -1 , Payer = 1 } |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| void | setupExpired () const override |

| Swap (Size legs) | |

| Protected Member Functions inherited from Instrument | |

| void | calculate () const override |

| void | performCalculations () const override |

| std::vector< Leg > | legs_ |

| std::vector< Real > | payer_ |

| std::vector< Real > | legNPV_ |

| std::vector< Real > | legBPS_ |

| std::vector< DiscountFactor > | startDiscounts_ |

| std::vector< DiscountFactor > | endDiscounts_ |

| DiscountFactor | npvDateDiscount_ |

| Protected Attributes inherited from Instrument | |

| Real | NPV_ |

| Real | errorEstimate_ |

| Date | valuationDate_ |

| std::map< std::string, ext::any > | additionalResults_ |

| ext::shared_ptr< PricingEngine > | engine_ |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

Detailed Description

Zero-coupon interest rate swap.

Quoted in terms of a known fixed cash flow \( N^{FIX} \) or a fixed rate \( R \), where:

\[N^{FIX} = N \left[ (1+R)^{\alpha(T_{0}, T_{K})}-1 \right] , \]

with \( \alpha(T_{0}, T_{K}) \) being the time fraction between the start date of the contract \( T_{0} \) and the end date \( T_{K} \) - according to a given day count convention. \( N \) is the base notional amount prior to compounding. The floating leg also pays a single cash flow \( N^{FLT} \), which value is determined by periodically averaging (e.g. every 6 months) interest rate index fixings. Assuming the use of compounded averaging the projected value of the floating leg becomes:

\[N^{FLT} = N \left[ \prod_{k=0}^{K-1} (1+\alpha(T_{k},T_{k+1}) L(T_{k},T_{k+1})) -1 \right], \]

where \( L(T_{i}, T_{j})) \) are interest rate index fixings for accrual period \( [T_{i}, T_{j}] \). For a par contract, it holds that:

\[P_n(0,T) N^{FIX} = P_n(0,T) N^{FLT} \]

where \( T \) is the final payment time, \( P_n(0,t) \) is the nominal discount factor at time \( t \).

At maturity the two single cashflows are swapped.

- Note

- we do not need Schedules on the legs because they use one or two dates only per leg. Those dates are not adjusted for potential non-business days. Only the payment date is subject to adjustment.

Member Function Documentation

◆ startDate()

◆ maturityDate()

Generated by Doxygen 1.15.0