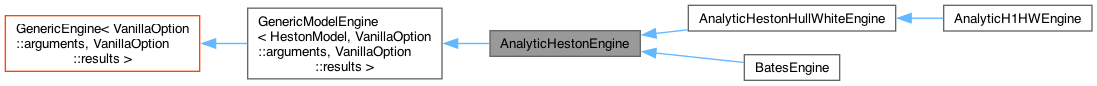

analytic Heston-model engine based on Fourier transform More...

#include <ql/pricingengines/vanilla/analytichestonengine.hpp>

Public Types | |

| enum | ComplexLogFormula { Gatheral , BranchCorrection , AndersenPiterbarg , AndersenPiterbargOptCV , AsymptoticChF , AngledContour , AngledContourNoCV , OptimalCV } |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

Public Member Functions | |

| AnalyticHestonEngine (const ext::shared_ptr< HestonModel > &model, Real relTolerance, Size maxEvaluations) | |

| AnalyticHestonEngine (const ext::shared_ptr< HestonModel > &model, Size integrationOrder=144) | |

| AnalyticHestonEngine (const ext::shared_ptr< HestonModel > &model, ComplexLogFormula cpxLog, const Integration &itg, Real andersenPiterbargEpsilon=1e-25, Real alpha=-0.5) | |

| void | calculate () const override |

| std::complex< Real > | chF (const std::complex< Real > &z, Time t) const |

| std::complex< Real > | lnChF (const std::complex< Real > &z, Time t) const |

| Size | numberOfEvaluations () const |

| Real | priceVanillaPayoff (const ext::shared_ptr< PlainVanillaPayoff > &payoff, const Date &maturity) const |

| Real | priceVanillaPayoff (const ext::shared_ptr< PlainVanillaPayoff > &payoff, Time maturity) const |

| Public Member Functions inherited from GenericModelEngine< HestonModel, VanillaOption::arguments, VanillaOption::results > | |

| GenericModelEngine (Handle< HestonModel > model=Handle< HestonModel >()) | |

| Public Member Functions inherited from GenericEngine< VanillaOption::arguments, VanillaOption::results > | |

| PricingEngine::arguments * | getArguments () const override |

| const PricingEngine::results * | getResults () const override |

| void | reset () override |

| void | update () override |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

Static Public Member Functions | |

| static void | doCalculation (Real riskFreeDiscount, Real dividendDiscount, Real spotPrice, Real strikePrice, Real term, Real kappa, Real theta, Real sigma, Real v0, Real rho, const TypePayoff &type, const Integration &integration, ComplexLogFormula cpxLog, const AnalyticHestonEngine *enginePtr, Real &value, Size &evaluations) |

| static ComplexLogFormula | optimalControlVariate (Time t, Real v0, Real kappa, Real theta, Real sigma, Real rho) |

Protected Member Functions | |

| virtual std::complex< Real > | addOnTerm (Real phi, Time t, Size j) const |

Additional Inherited Members | |

| Protected Attributes inherited from GenericModelEngine< HestonModel, VanillaOption::arguments, VanillaOption::results > | |

| Handle< HestonModel > | model_ |

| Protected Attributes inherited from GenericEngine< VanillaOption::arguments, VanillaOption::results > | |

| VanillaOption::arguments | arguments_ |

| VanillaOption::results | results_ |

Detailed Description

analytic Heston-model engine based on Fourier transform

Integration detail: Two algebraically equivalent formulations of the complex logarithm of the Heston model exist. Gatherals [2005] (also Duffie, Pan and Singleton [2000], and Schoutens, Simons and Tistaert[2004]) version does not cause discoutinuities whereas the original version (e.g. Heston [1993]) needs some sort of "branch correction" to work properly. Gatheral's version does also work with adaptive integration routines and should be preferred over the original Heston version.

References:

Heston, Steven L., 1993. A Closed-Form Solution for Options with Stochastic Volatility with Applications to Bond and Currency Options. The review of Financial Studies, Volume 6, Issue 2, 327-343.

A. Sepp, Pricing European-Style Options under Jump Diffusion Processes with Stochastic Volatility: Applications of Fourier Transform (http://math.ut.ee/~spartak/papers/stochjumpvols.pdf)

R. Lord and C. Kahl, Why the rotation count algorithm works, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=921335

H. Albrecher, P. Mayer, W.Schoutens and J. Tistaert, The Little Heston Trap, http://www.schoutens.be/HestonTrap.pdf

J. Gatheral, The Volatility Surface: A Practitioner's Guide, Wiley Finance

F. Le Floc'h, Fourier Integration and Stochastic Volatility Calibration, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2362968

L. Andersen, and V. Piterbarg, 2010, Interest Rate Modeling, Volume I: Foundations and Vanilla Models, Atlantic Financial Press London.

L. Andersen and M. Lake, 2018 Robust High-Precision Option Pricing by Fourier Transforms: Contour Deformations and Double-Exponential Quadrature, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3231626

- Tests

- the correctness of the returned value is tested by reproducing results available in web/literature and comparison with Black pricing.

Member Function Documentation

◆ calculate()

|

overridevirtual |

Implements PricingEngine.

Generated by Doxygen 1.15.0