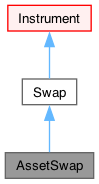

Bullet bond vs Libor swap. More...

#include <ql/instruments/assetswap.hpp>

Classes | |

| class | arguments |

| Arguments for asset swap calculation More... | |

| class | results |

| Results from simple swap calculation More... | |

Public Member Functions | |

| AssetSwap (bool payBondCoupon, ext::shared_ptr< Bond > bond, Real bondCleanPrice, const ext::shared_ptr< IborIndex > &iborIndex, Spread spread, Schedule floatSchedule=Schedule(), const DayCounter &floatingDayCount=DayCounter(), bool parAssetSwap=true, Real gearing=1.0, Real nonParRepayment=Null< Real >(), Date dealMaturity=Date()) | |

| AssetSwap (bool parAssetSwap, ext::shared_ptr< Bond > bond, Real bondCleanPrice, Real nonParRepayment, Real gearing, const ext::shared_ptr< IborIndex > &iborIndex, Spread spread=0.0, const DayCounter &floatingDayCount=DayCounter(), Date dealMaturity=Date(), bool payBondCoupon=false) | |

| Spread | fairSpread () const |

| Real | floatingLegBPS () const |

| Real | floatingLegNPV () const |

| Real | fairCleanPrice () const |

| Real | fairNonParRepayment () const |

| bool | parSwap () const |

| Spread | spread () const |

| Real | cleanPrice () const |

| Real | nonParRepayment () const |

| const ext::shared_ptr< Bond > & | bond () const |

| bool | payBondCoupon () const |

| const Leg & | bondLeg () const |

| const Leg & | floatingLeg () const |

| void | setupArguments (PricingEngine::arguments *args) const override |

| void | fetchResults (const PricingEngine::results *) const override |

| Public Member Functions inherited from Swap | |

| void | deepUpdate () override |

| Size | numberOfLegs () const |

| const std::vector< Leg > & | legs () const |

| virtual Date | startDate () const |

| virtual Date | maturityDate () const |

| Real | legBPS (Size j) const |

| Real | legNPV (Size j) const |

| DiscountFactor | startDiscounts (Size j) const |

| DiscountFactor | endDiscounts (Size j) const |

| DiscountFactor | npvDateDiscount () const |

| const Leg & | leg (Size j) const |

| bool | payer (Size j) const |

| bool | isExpired () const override |

| returns whether the instrument might have value greater than zero. | |

| void | setupArguments (PricingEngine::arguments *) const override |

| void | fetchResults (const PricingEngine::results *) const override |

| Swap (const Leg &firstLeg, const Leg &secondLeg) | |

| Swap (const std::vector< Leg > &legs, const std::vector< bool > &payer) | |

| Public Member Functions inherited from Instrument | |

| Real | NPV () const |

| returns the net present value of the instrument. | |

| Real | errorEstimate () const |

| returns the error estimate on the NPV when available. | |

| const Date & | valuationDate () const |

| returns the date the net present value refers to. | |

| const ext::shared_ptr< PricingEngine > & | pricingEngine () const |

| template<typename T> | |

| T | result (const std::string &tag) const |

| returns any additional result returned by the pricing engine. | |

| const std::map< std::string, ext::any > & | additionalResults () const |

| returns all additional result returned by the pricing engine. | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &) |

| set the pricing engine to be used. | |

| Public Member Functions inherited from LazyObject | |

| void | update () override |

| bool | isCalculated () const |

| void | setCalculated (bool c) const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

Additional Inherited Members | |

| Public Types inherited from Swap | |

| enum | Type { Receiver = -1 , Payer = 1 } |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| void | setupExpired () const override |

| Swap (Size legs) | |

| Protected Member Functions inherited from Instrument | |

| void | calculate () const override |

| void | performCalculations () const override |

| std::vector< Leg > | legs_ |

| std::vector< Real > | payer_ |

| std::vector< Real > | legNPV_ |

| std::vector< Real > | legBPS_ |

| std::vector< DiscountFactor > | startDiscounts_ |

| std::vector< DiscountFactor > | endDiscounts_ |

| DiscountFactor | npvDateDiscount_ |

| Protected Attributes inherited from Instrument | |

| Real | NPV_ |

| Real | errorEstimate_ |

| Date | valuationDate_ |

| std::map< std::string, ext::any > | additionalResults_ |

| ext::shared_ptr< PricingEngine > | engine_ |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

Detailed Description

Bullet bond vs Libor swap.

for mechanics of par asset swap and market asset swap, refer to "Introduction to Asset Swap", Lehman Brothers European Fixed Income Research - January 2000, D. O'Kane

- Warning

- bondCleanPrice must be the (forward) price at the floatSchedule start date

- Bug

- fair prices are not calculated correctly when using indexed coupons.

Constructor & Destructor Documentation

◆ AssetSwap() [1/2]

| AssetSwap | ( | bool | payBondCoupon, |

| ext::shared_ptr< Bond > | bond, | ||

| Real | bondCleanPrice, | ||

| const ext::shared_ptr< IborIndex > & | iborIndex, | ||

| Spread | spread, | ||

| Schedule | floatSchedule = Schedule(), | ||

| const DayCounter & | floatingDayCount = DayCounter(), | ||

| bool | parAssetSwap = true, | ||

| Real | gearing = 1.0, | ||

| Real | nonParRepayment = Null< Real >(), | ||

| Date | dealMaturity = Date() ) |

If the passed iborIndex is an overnight rate such as SOFR, ESTR or SONIA, the floatSchedule argument is required and will be used to build overnight-indexed coupons.

◆ AssetSwap() [2/2]

| AssetSwap | ( | bool | parAssetSwap, |

| ext::shared_ptr< Bond > | bond, | ||

| Real | bondCleanPrice, | ||

| Real | nonParRepayment, | ||

| Real | gearing, | ||

| const ext::shared_ptr< IborIndex > & | iborIndex, | ||

| Spread | spread = 0.0, | ||

| const DayCounter & | floatingDayCount = DayCounter(), | ||

| Date | dealMaturity = Date(), | ||

| bool | payBondCoupon = false ) |

- Deprecated

- Use the other overload. Deprecated in version 1.37.

Member Function Documentation

◆ setupArguments()

|

overridevirtual |

When a derived argument structure is defined for an instrument, this method should be overridden to fill it. This is mandatory in case a pricing engine is used.

Reimplemented from Instrument.

◆ fetchResults()

|

overridevirtual |

When a derived result structure is defined for an instrument, this method should be overridden to read from it. This is mandatory in case a pricing engine is used.

Reimplemented from Instrument.

Generated by Doxygen 1.15.0