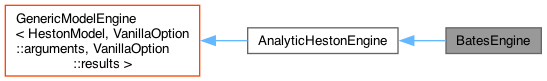

Bates model engines based on Fourier transform. More...

#include <ql/pricingengines/vanilla/batesengine.hpp>

Public Member Functions | |

| BatesEngine (const ext::shared_ptr< BatesModel > &model, Size integrationOrder=144) | |

| BatesEngine (const ext::shared_ptr< BatesModel > &model, Real relTolerance, Size maxEvaluations) | |

| Public Member Functions inherited from AnalyticHestonEngine | |

| AnalyticHestonEngine (const ext::shared_ptr< HestonModel > &model, Real relTolerance, Size maxEvaluations) | |

| AnalyticHestonEngine (const ext::shared_ptr< HestonModel > &model, Size integrationOrder=144) | |

| AnalyticHestonEngine (const ext::shared_ptr< HestonModel > &model, ComplexLogFormula cpxLog, const Integration &itg, Real andersenPiterbargEpsilon=1e-25, Real alpha=-0.5) | |

| void | calculate () const override |

| std::complex< Real > | chF (const std::complex< Real > &z, Time t) const |

| std::complex< Real > | lnChF (const std::complex< Real > &z, Time t) const |

| Size | numberOfEvaluations () const |

| Real | priceVanillaPayoff (const ext::shared_ptr< PlainVanillaPayoff > &payoff, const Date &maturity) const |

| Real | priceVanillaPayoff (const ext::shared_ptr< PlainVanillaPayoff > &payoff, Time maturity) const |

| Public Member Functions inherited from GenericModelEngine< HestonModel, VanillaOption::arguments, VanillaOption::results > | |

| GenericModelEngine (Handle< HestonModel > model=Handle< HestonModel >()) | |

| Public Member Functions inherited from GenericEngine< VanillaOption::arguments, VanillaOption::results > | |

| PricingEngine::arguments * | getArguments () const override |

| const PricingEngine::results * | getResults () const override |

| void | reset () override |

| void | update () override |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

Protected Member Functions | |

| std::complex< Real > | addOnTerm (Real phi, Time t, Size j) const override |

Additional Inherited Members | |

| Public Types inherited from AnalyticHestonEngine | |

| enum | ComplexLogFormula { Gatheral , BranchCorrection , AndersenPiterbarg , AndersenPiterbargOptCV , AsymptoticChF , AngledContour , AngledContourNoCV , OptimalCV } |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| Static Public Member Functions inherited from AnalyticHestonEngine | |

| static void | doCalculation (Real riskFreeDiscount, Real dividendDiscount, Real spotPrice, Real strikePrice, Real term, Real kappa, Real theta, Real sigma, Real v0, Real rho, const TypePayoff &type, const Integration &integration, ComplexLogFormula cpxLog, const AnalyticHestonEngine *enginePtr, Real &value, Size &evaluations) |

| static ComplexLogFormula | optimalControlVariate (Time t, Real v0, Real kappa, Real theta, Real sigma, Real rho) |

| Protected Attributes inherited from GenericModelEngine< HestonModel, VanillaOption::arguments, VanillaOption::results > | |

| Handle< HestonModel > | model_ |

| Protected Attributes inherited from GenericEngine< VanillaOption::arguments, VanillaOption::results > | |

| VanillaOption::arguments | arguments_ |

| VanillaOption::results | results_ |

Detailed Description

Bates model engines based on Fourier transform.

this classes price european options under the following processes

Jump-Diffusion with Stochastic Volatility

\[\begin{array}{rcl} dS(t, S) &=& (r-d-\lambda m) S dt +\sqrt{v} S dW_1 + (e^J - 1) S dN \\ dv(t, S) &=& \kappa (\theta - v) dt + \sigma \sqrt{v} dW_2 \\ dW_1 dW_2 &=& \rho dt \end{array} \]

N is a Poisson process with the intensity \( \lambda \). When a jump occurs the magnitude J has the probability density function \( \omega(J) \).

1.1 Log-Normal Jump Diffusion: BatesEngine

Logarithm of the jump size J is normally distributed

\[\omega(J) = \frac{1}{\sqrt{2\pi \delta^2}} \exp\left[-\frac{(J-\nu)^2}{2\delta^2}\right] \]

1.2 Double-Exponential Jump Diffusion: BatesDoubleExpEngine

The jump size has an asymmetric double exponential distribution

\[\begin{array}{rcl} \omega(J)&=& p\frac{1}{\eta_u}e^{-\frac{1}{\eta_u}J} 1_{J>0} + q\frac{1}{\eta_d}e^{\frac{1}{\eta_d}J} 1_{J<0} \\ p + q &=& 1 \end{array} \]

Stochastic Volatility with Jump Diffusion and Deterministic Jump Intensity

\[\begin{array}{rcl} dS(t, S) &=& (r-d-\lambda m) S dt +\sqrt{v} S dW_1 + (e^J - 1) S dN \\ dv(t, S) &=& \kappa (\theta - v) dt + \sigma \sqrt{v} dW_2 \\ d\lambda(t) &=& \kappa_\lambda(\theta_\lambda-\lambda) dt \\ dW_1 dW_2 &=& \rho dt \end{array} \]

2.1 Log-Normal Jump Diffusion with Deterministic Jump Intensity BatesDetJumpEngine

2.2 Double-Exponential Jump Diffusion with Deterministic Jump Intensity BatesDoubleExpDetJumpEngine

References:

D. Bates, Jumps and stochastic volatility: exchange rate processes implicit in Deutsche mark options, Review of Financial Sudies 9, 69-107.

A. Sepp, Pricing European-Style Options under Jump Diffusion Processes with Stochastic Volatility: Applications of Fourier Transform (http://math.ut.ee/~spartak/papers/stochjumpvols.pdf)

Member Function Documentation

◆ addOnTerm()

Reimplemented from AnalyticHestonEngine.

Generated by Doxygen 1.15.0