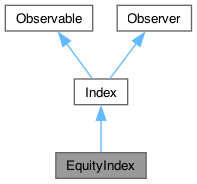

Base class for equity indexes. More...

#include <ql/indexes/equityindex.hpp>

Public Member Functions | |

| EquityIndex (std::string name, Calendar fixingCalendar, Currency currency, Handle< YieldTermStructure > interest={}, Handle< YieldTermStructure > dividend={}, Handle< Quote > spot={}) | |

Index interface | |

| std::string | name () const override |

| Returns the name of the index. | |

| Calendar | fixingCalendar () const override |

| returns the calendar defining valid fixing dates | |

| bool | isValidFixingDate (const Date &fixingDate) const override |

| returns TRUE if the fixing date is a valid one | |

| Real | fixing (const Date &fixingDate, bool forecastTodaysFixing=false) const override |

| returns the fixing at the given date | |

Inspectors | |

| Currency | currency () const |

| The index currency. | |

| Handle< YieldTermStructure > | equityInterestRateCurve () const |

| the rate curve used to forecast fixings | |

| Handle< YieldTermStructure > | equityDividendCurve () const |

| the dividend curve used to forecast fixings | |

| Handle< Quote > | spot () const |

| index spot value | |

Fixing calculations | |

| virtual Real | forecastFixing (const Date &fixingDate) const |

| It can be overridden to implement particular conventions. | |

| Public Member Functions inherited from Index | |

| bool | hasHistoricalFixing (const Date &fixingDate) const |

| returns whether a historical fixing was stored for the given date | |

| virtual Real | pastFixing (const Date &fixingDate) const |

| returns a past fixing at the given date | |

| const TimeSeries< Real > & | timeSeries () const |

| returns the fixing TimeSeries | |

| virtual bool | allowsNativeFixings () |

| check if index allows for native fixings. | |

| void | update () override |

| virtual void | addFixing (const Date &fixingDate, Real fixing, bool forceOverwrite=false) |

| void | addFixings (const TimeSeries< Real > &t, bool forceOverwrite=false) |

| stores historical fixings from a TimeSeries | |

| template<class DateIterator, class ValueIterator> | |

| void | addFixings (DateIterator dBegin, DateIterator dEnd, ValueIterator vBegin, bool forceOverwrite=false) |

| stores historical fixings at the given dates | |

| void | clearFixings () |

| clears all stored historical fixings | |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

Other methods | |

| virtual ext::shared_ptr< EquityIndex > | clone (const Handle< YieldTermStructure > &interest, const Handle< YieldTermStructure > ÷nd, const Handle< Quote > &spot) const |

Additional Inherited Members | |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| ext::shared_ptr< Observable > | notifier () const |

Detailed Description

Base class for equity indexes.

The equity index object allows to retrieve past fixings, as well as project future fixings using either both the risk free interest rate term structure and the dividend term structure, or just the interest rate term structure in which case one can provide a term structure of equity forwards implied from, e.g. option prices.

In case of the first method, the forward is calculated as:

\[I(t, T) = I(t, t) \frac{P_{D}(t, T)}{P_{R}(t, T)}, \]

where \( I(t, t) \) is today's value of the index, \( P_{D}(t, T) \) is a discount factor of the dividend curve at future time \( T \), and \( P_{R}(t, T) \) is a discount factor of the risk free curve at future time \( T \).

In case of the latter method, the forward is calculated as:

\[I(t, T) = I(t, t) \frac{1}{P_{F}(t, T)}, \]

where \( P_{F}(t, T) \) is a discount factor of the equity forward term structure.

To forecast future fixings, the user can either provide a handle to the current index spot. If spot handle is empty, today's fixing will be used, instead.

Member Function Documentation

◆ name()

|

overridevirtual |

◆ fixingCalendar()

|

overridevirtual |

returns the calendar defining valid fixing dates

Implements Index.

◆ isValidFixingDate()

|

overridevirtual |

returns TRUE if the fixing date is a valid one

Implements Index.

◆ fixing()

returns the fixing at the given date

the date passed as arguments must be the actual calendar date of the fixing; no settlement days must be used.

Implements Index.

◆ clone()

|

virtual |

returns a copy of itself linked to different interest, dividend curves or spot quote

Generated by Doxygen 1.15.0