Discount curve fitted to a set of fixed-coupon bonds. More...

#include <ql/termstructures/yield/fittedbonddiscountcurve.hpp>

Classes | |

| class | FittingMethod |

| Base fitting method used to construct a fitted bond discount curve. More... | |

Public Member Functions | |

Constructors | |

| FittedBondDiscountCurve (Natural settlementDays, const Calendar &calendar, std::vector< ext::shared_ptr< BondHelper > > bonds, const DayCounter &dayCounter, const FittingMethod &fittingMethod, Real accuracy=1.0e-10, Size maxEvaluations=10000, Array guess=Array(), Real simplexLambda=1.0, Size maxStationaryStateIterations=100) | |

| reference date based on current evaluation date | |

| FittedBondDiscountCurve (const Date &referenceDate, std::vector< ext::shared_ptr< BondHelper > > bonds, const DayCounter &dayCounter, const FittingMethod &fittingMethod, Real accuracy=1.0e-10, Size maxEvaluations=10000, Array guess=Array(), Real simplexLambda=1.0, Size maxStationaryStateIterations=100) | |

| curve reference date fixed for life of curve | |

| FittedBondDiscountCurve (Natural settlementDays, const Calendar &calendar, const FittingMethod &fittingMethod, Array parameters, Date maxDate, const DayCounter &dayCounter) | |

| don't fit, use precalculated parameters | |

| FittedBondDiscountCurve (const Date &referenceDate, const FittingMethod &fittingMethod, Array parameters, Date maxDate, const DayCounter &dayCounter) | |

| don't fit, use precalculated parameters | |

Inspectors | |

| Size | numberOfBonds () const |

| total number of bonds used to fit the yield curve | |

| Date | maxDate () const override |

| the latest date for which the curve can return values | |

| const FittingMethod & | fitResults () const |

| class holding the results of the fit | |

Other utilities | |

| void | resetGuess (const Array &guess) |

| Public Member Functions inherited from YieldTermStructure | |

| YieldTermStructure (const DayCounter &dc=DayCounter()) | |

| YieldTermStructure (const Date &referenceDate, const Calendar &cal=Calendar(), const DayCounter &dc=DayCounter(), std::vector< Handle< Quote > > jumps={}, const std::vector< Date > &jumpDates={}) | |

| YieldTermStructure (Natural settlementDays, const Calendar &cal, const DayCounter &dc=DayCounter(), std::vector< Handle< Quote > > jumps={}, const std::vector< Date > &jumpDates={}) | |

| DiscountFactor | discount (const Date &d, bool extrapolate=false) const |

| DiscountFactor | discount (Time t, bool extrapolate=false) const |

| InterestRate | zeroRate (const Date &d, const DayCounter &resultDayCounter, Compounding comp, Frequency freq=Annual, bool extrapolate=false) const |

| InterestRate | zeroRate (Time t, Compounding comp, Frequency freq=Annual, bool extrapolate=false) const |

| InterestRate | forwardRate (const Date &d1, const Date &d2, const DayCounter &resultDayCounter, Compounding comp, Frequency freq=Annual, bool extrapolate=false) const |

| InterestRate | forwardRate (const Date &d, const Period &p, const DayCounter &resultDayCounter, Compounding comp, Frequency freq=Annual, bool extrapolate=false) const |

| InterestRate | forwardRate (Time t1, Time t2, Compounding comp, Frequency freq=Annual, bool extrapolate=false) const |

| const std::vector< Date > & | jumpDates () const |

| const std::vector< Time > & | jumpTimes () const |

| void | update () override |

| Public Member Functions inherited from TermStructure | |

| TermStructure (DayCounter dc=DayCounter()) | |

| default constructor | |

| TermStructure (const Date &referenceDate, Calendar calendar=Calendar(), DayCounter dc=DayCounter()) | |

| initialize with a fixed reference date | |

| TermStructure (Natural settlementDays, Calendar, DayCounter dc=DayCounter()) | |

| calculate the reference date based on the global evaluation date | |

| virtual DayCounter | dayCounter () const |

| the day counter used for date/time conversion | |

| Time | timeFromReference (const Date &date) const |

| date/time conversion | |

| virtual Time | maxTime () const |

| the latest time for which the curve can return values | |

| virtual const Date & | referenceDate () const |

| the date at which discount = 1.0 and/or variance = 0.0 | |

| virtual Calendar | calendar () const |

| the calendar used for reference and/or option date calculation | |

| virtual Natural | settlementDays () const |

| the settlementDays used for reference date calculation | |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Extrapolator | |

| void | enableExtrapolation (bool b=true) |

| enable extrapolation in subsequent calls | |

| void | disableExtrapolation (bool b=true) |

| disable extrapolation in subsequent calls | |

| bool | allowsExtrapolation () const |

| tells whether extrapolation is enabled | |

| Public Member Functions inherited from LazyObject | |

| void | update () override |

| bool | isCalculated () const |

| void | setCalculated (bool c) const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

Observer interface | |

| void | update () override |

Additional Inherited Members | |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| void | checkRange (const Date &d, bool extrapolate) const |

| date-range check | |

| void | checkRange (Time t, bool extrapolate) const |

| time-range check | |

| virtual void | calculate () const |

| bool | moving_ = false |

| bool | updated_ = true |

| Calendar | calendar_ |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

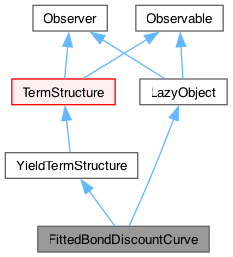

Detailed Description

Discount curve fitted to a set of fixed-coupon bonds.

This class fits a discount function \( d(t) \) over a set of bonds, using a user defined fitting method. The discount function is fit in such a way so that all cashflows of all input bonds, when discounted using \( d(t) \), will reproduce the set of input bond prices in an optimized sense. Minimized price errors are weighted by the inverse of their respective bond duration.

The FittedBondDiscountCurve class acts as a generic wrapper, while its inner class FittingMethod provides the implementation details. Developers thus need only derive new fitting methods from the latter.

- Warning

- The method can be slow if there are many bonds to fit. Speed also depends on the particular choice of fitting method chosen and its convergence properties under optimization. See also todo list for BondDiscountCurveFittingMethod.

Member Function Documentation

◆ maxDate()

|

overridevirtual |

the latest date for which the curve can return values

Implements TermStructure.

◆ resetGuess()

| void resetGuess | ( | const Array & | guess | ) |

This allows to try out multiple guesses and avoid local minima

◆ update()

|

overridevirtual |

This method must be implemented in derived classes. An instance of Observer does not call this method directly: instead, it will be called by the observables the instance registered with when they need to notify any changes.

Implements Observer.

Generated by Doxygen 1.15.0