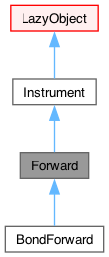

Abstract base forward class. More...

#include <ql/instruments/forward.hpp>

Public Member Functions | |

Inspectors | |

| virtual Date | settlementDate () const |

| const Calendar & | calendar () const |

| BusinessDayConvention | businessDayConvention () const |

| const DayCounter & | dayCounter () const |

| Handle< YieldTermStructure > | discountCurve () const |

| term structure relevant to the contract (e.g. repo curve) | |

| Handle< YieldTermStructure > | incomeDiscountCurve () const |

| term structure that discounts the underlying's income cash flows | |

| bool | isExpired () const override |

| returns whether the instrument is still tradable. | |

| virtual Real | spotValue () const =0 |

| returns spot value/price of an underlying financial instrument | |

| virtual Real | spotIncome (const Handle< YieldTermStructure > &incomeDiscountCurve) const =0 |

| NPV of income/dividends/storage-costs etc. of underlying instrument. | |

| Public Member Functions inherited from Instrument | |

| Real | NPV () const |

| returns the net present value of the instrument. | |

| Real | errorEstimate () const |

| returns the error estimate on the NPV when available. | |

| const Date & | valuationDate () const |

| returns the date the net present value refers to. | |

| const ext::shared_ptr< PricingEngine > & | pricingEngine () const |

| template<typename T> | |

| T | result (const std::string &tag) const |

| returns any additional result returned by the pricing engine. | |

| const std::map< std::string, ext::any > & | additionalResults () const |

| returns all additional result returned by the pricing engine. | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &) |

| set the pricing engine to be used. | |

| virtual void | setupArguments (PricingEngine::arguments *) const |

| virtual void | fetchResults (const PricingEngine::results *) const |

| Public Member Functions inherited from LazyObject | |

| void | update () override |

| bool | isCalculated () const |

| void | setCalculated (bool c) const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

Calculations | |

| Real | underlyingIncome_ |

| Real | underlyingSpotValue_ |

| DayCounter | dayCounter_ |

| Calendar | calendar_ |

| BusinessDayConvention | businessDayConvention_ |

| Natural | settlementDays_ |

| ext::shared_ptr< Payoff > | payoff_ |

| Date | valueDate_ |

| Date | maturityDate_ |

| maturityDate of the forward contract or delivery date of underlying | |

| Handle< YieldTermStructure > | discountCurve_ |

| Handle< YieldTermStructure > | incomeDiscountCurve_ |

| virtual Real | forwardValue () const |

| forward value/price of underlying, discounting income/dividends | |

| InterestRate | impliedYield (Real underlyingSpotValue, Real forwardValue, Date settlementDate, Compounding compoundingConvention, const DayCounter &dayCounter) |

| Forward (DayCounter dayCounter, Calendar calendar, BusinessDayConvention businessDayConvention, Natural settlementDays, ext::shared_ptr< Payoff > payoff, const Date &valueDate, const Date &maturityDate, Handle< YieldTermStructure > discountCurve=Handle< YieldTermStructure >()) | |

| void | performCalculations () const override |

Additional Inherited Members | |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| Protected Member Functions inherited from Instrument | |

| void | calculate () const override |

| virtual void | setupExpired () const |

| void | performCalculations () const override |

| Protected Attributes inherited from Instrument | |

| Real | NPV_ |

| Real | errorEstimate_ |

| Date | valuationDate_ |

| std::map< std::string, ext::any > | additionalResults_ |

| ext::shared_ptr< PricingEngine > | engine_ |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

Detailed Description

Abstract base forward class.

Derived classes must implement the virtual functions spotValue() (NPV or spot price) and spotIncome() associated with the specific relevant underlying (e.g. bond, stock, commodity, loan/deposit). These functions must be used to set the protected member variables underlyingSpotValue_ and underlyingIncome_ within performCalculations() in the derived class before the base-class implementation is called.

spotIncome() refers generically to the present value of coupons, dividends or storage costs.

discountCurve_ is the curve used to discount forward contract cash flows back to the evaluation day, as well as to obtain forward values for spot values/prices.

incomeDiscountCurve_, which for generality is not automatically set to the discountCurve_, is the curve used to discount future income/dividends/storage-costs etc back to the evaluation date.

- Warning

- This class still needs to be rigorously tested

Member Function Documentation

◆ isExpired()

|

overridevirtual |

returns whether the instrument is still tradable.

Implements Instrument.

◆ spotValue()

|

pure virtual |

returns spot value/price of an underlying financial instrument

Implemented in BondForward.

◆ spotIncome()

|

pure virtual |

NPV of income/dividends/storage-costs etc. of underlying instrument.

Implemented in BondForward.

◆ forwardValue()

|

virtual |

forward value/price of underlying, discounting income/dividends

- Note

- if this is a bond forward price, is must be a dirty forward price.

◆ impliedYield()

| InterestRate impliedYield | ( | Real | underlyingSpotValue, |

| Real | forwardValue, | ||

| Date | settlementDate, | ||

| Compounding | compoundingConvention, | ||

| const DayCounter & | dayCounter ) |

Simple yield calculation based on underlying spot and forward values, taking into account underlying income. When \( t>0 \), call with: underlyingSpotValue=spotValue(t), forwardValue=strikePrice, to get current yield. For a repo, if \( t=0 \), impliedYield should reproduce the spot repo rate. For FRA's, this should reproduce the relevant zero rate at the FRA's maturityDate_;

- Examples

- Repo.cpp.

◆ performCalculations()

|

overrideprotectedvirtual |

This method must implement any calculations which must be (re)done in order to calculate the desired results.

Implements LazyObject.

Member Data Documentation

◆ underlyingIncome_

|

mutableprotected |

derived classes must set this, typically via spotIncome()

◆ underlyingSpotValue_

|

mutableprotected |

derived classes must set this, typically via spotValue()

◆ valueDate_

|

protected |

valueDate = settlement date (date the fwd contract starts accruing)

◆ incomeDiscountCurve_

|

protected |

must set this in derived classes, based on particular underlying

Generated by Doxygen 1.15.0