HestonModelHelper Class Reference

calibration helper for Heston model More...

#include <ql/models/equity/hestonmodelhelper.hpp>

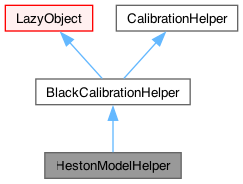

Inheritance diagram for HestonModelHelper:

Public Member Functions | |

| HestonModelHelper (const Period &maturity, Calendar calendar, Real s0, Real strikePrice, const Handle< Quote > &volatility, const Handle< YieldTermStructure > &riskFreeRate, const Handle< YieldTermStructure > ÷ndYield, BlackCalibrationHelper::CalibrationErrorType errorType=BlackCalibrationHelper::RelativePriceError) | |

| HestonModelHelper (const Period &maturity, Calendar calendar, const Handle< Quote > &s0, Real strikePrice, const Handle< Quote > &volatility, const Handle< YieldTermStructure > &riskFreeRate, const Handle< YieldTermStructure > ÷ndYield, BlackCalibrationHelper::CalibrationErrorType errorType=BlackCalibrationHelper::RelativePriceError) | |

| void | addTimesTo (std::list< Time > &) const override |

| void | performCalculations () const override |

| Real | modelValue () const override |

| returns the price of the instrument according to the model | |

| Real | blackPrice (Real volatility) const override |

| Black or Bachelier price given a volatility. | |

| Time | maturity () const |

| Public Member Functions inherited from BlackCalibrationHelper | |

| BlackCalibrationHelper (Handle< Quote > volatility, CalibrationErrorType calibrationErrorType=RelativePriceError, const VolatilityType type=ShiftedLognormal, const Real shift=0.0) | |

| Handle< Quote > | volatility () const |

| returns the volatility Handle | |

| VolatilityType | volatilityType () const |

| returns the volatility type | |

| Real | marketValue () const |

| returns the actual price of the instrument (from volatility) | |

| Real | calibrationError () override |

| returns the error resulting from the model valuation | |

| Volatility | impliedVolatility (Real targetValue, Real accuracy, Size maxEvaluations, Volatility minVol, Volatility maxVol) const |

| Black volatility implied by the model. | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &engine) |

| Public Member Functions inherited from LazyObject | |

| void | update () override |

| bool | isCalculated () const |

| void | setCalculated (bool c) const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

Additional Inherited Members | |

| Public Types inherited from BlackCalibrationHelper | |

| enum | CalibrationErrorType { RelativePriceError , PriceError , ImpliedVolError } |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| virtual void | calculate () const |

| Protected Attributes inherited from BlackCalibrationHelper | |

| Real | marketValue_ |

| Handle< Quote > | volatility_ |

| ext::shared_ptr< PricingEngine > | engine_ |

| const VolatilityType | volatilityType_ |

| const Real | shift_ |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

Detailed Description

calibration helper for Heston model

Member Function Documentation

◆ addTimesTo()

|

overridevirtual |

Implements BlackCalibrationHelper.

◆ performCalculations()

|

overridevirtual |

This method must implement any calculations which must be (re)done in order to calculate the desired results.

Reimplemented from BlackCalibrationHelper.

◆ modelValue()

|

overridevirtual |

returns the price of the instrument according to the model

Implements BlackCalibrationHelper.

◆ blackPrice()

Black or Bachelier price given a volatility.

Implements BlackCalibrationHelper.

Generated by Doxygen 1.15.0