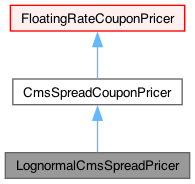

CMS spread - coupon pricer. More...

#include <ql/experimental/coupons/lognormalcmsspreadpricer.hpp>

Public Member Functions | |

| LognormalCmsSpreadPricer (const ext::shared_ptr< CmsCouponPricer > &cmsPricer, const Handle< Quote > &correlation, Handle< YieldTermStructure > couponDiscountCurve=Handle< YieldTermStructure >(), Size IntegrationPoints=16, const ext::optional< VolatilityType > &volatilityType=ext::nullopt, Real shift1=Null< Real >(), Real shift2=Null< Real >()) | |

| Real | swapletPrice () const override |

| Rate | swapletRate () const override |

| Real | capletPrice (Rate effectiveCap) const override |

| Rate | capletRate (Rate effectiveCap) const override |

| Real | floorletPrice (Rate effectiveFloor) const override |

| Rate | floorletRate (Rate effectiveFloor) const override |

| Public Member Functions inherited from CmsSpreadCouponPricer | |

| CmsSpreadCouponPricer (Handle< Quote > correlation=Handle< Quote >()) | |

| Handle< Quote > | correlation () const |

| void | setCorrelation (const Handle< Quote > &correlation=Handle< Quote >()) |

| Public Member Functions inherited from FloatingRateCouponPricer | |

| void | update () override |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

Additional Inherited Members | |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

Detailed Description

CMS spread - coupon pricer.

The swap rate adjustments are computed using the given volatility structures for the underlyings in every case (w.r.t. volatility type and shift).

For the bivariate spread model, the volatility type and the shifts can be inherited (default), or explicitly specified. In the latter case the type, and (if lognormal) the shifts must be given (or are defaulted to zero, if not given).

References:

Brigo, Mercurio: Interst Rate Models - Theory and Practice, 2nd Edition, Springer, 2006, chapter 13.6.2

Member Function Documentation

◆ swapletPrice()

|

overridevirtual |

Implements FloatingRateCouponPricer.

◆ swapletRate()

|

overridevirtual |

Implements FloatingRateCouponPricer.

◆ capletPrice()

Implements FloatingRateCouponPricer.

◆ capletRate()

Implements FloatingRateCouponPricer.

◆ floorletPrice()

Implements FloatingRateCouponPricer.

◆ floorletRate()

Implements FloatingRateCouponPricer.

Generated by Doxygen 1.15.0