OvernightIndexedCoupon Class Reference

overnight coupon More...

#include <ql/cashflows/overnightindexedcoupon.hpp>

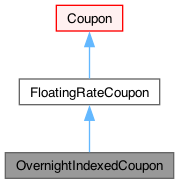

Inheritance diagram for OvernightIndexedCoupon:

Public Member Functions | |

| OvernightIndexedCoupon (const Date &paymentDate, Real nominal, const Date &startDate, const Date &endDate, const ext::shared_ptr< OvernightIndex > &overnightIndex, Real gearing=1.0, Spread spread=0.0, const Date &refPeriodStart=Date(), const Date &refPeriodEnd=Date(), const DayCounter &dayCounter=DayCounter(), bool telescopicValueDates=false, RateAveraging::Type averagingMethod=RateAveraging::Compound, Natural lookbackDays=Null< Natural >(), Natural lockoutDays=0, bool applyObservationShift=false, bool compoundSpread=false, const Date &rateComputationStartDate=Date(), const Date &rateComputationEndDate=Date()) | |

Inspectors | |

| const std::vector< Date > & | fixingDates () const |

| fixing dates for the rates to be compounded | |

| const std::vector< Time > & | dt () const |

| accrual (compounding) periods | |

| const std::vector< Rate > & | indexFixings () const |

| fixings to be compounded | |

| const std::vector< Date > & | valueDates () const |

| value dates for the rates to be compounded | |

| const std::vector< Date > & | interestDates () const |

| interest dates for the rates to be compounded | |

| RateAveraging::Type | averagingMethod () const |

| averaging method | |

| Natural | lockoutDays () const |

| lockout days | |

| bool | applyObservationShift () const |

| apply observation shift | |

| bool | compoundSpreadDaily () const |

| is the spread compounded daily or added after compounding? | |

| Real | effectiveSpread () const |

| Real | effectiveIndexFixing () const |

| const Date & | rateComputationStartDate () const |

| rate computation start date | |

| const Date & | rateComputationEndDate () const |

| rate computation end date | |

FloatingRateCoupon interface | |

| Date | fixingDate () const override |

| the date when the coupon is fully determined | |

| Real | accruedAmount (const Date &) const override |

| accrued amount at the given date | |

Visitability | |

| void | accept (AcyclicVisitor &) override |

| Public Member Functions inherited from FloatingRateCoupon | |

| FloatingRateCoupon (const Date &paymentDate, Real nominal, const Date &startDate, const Date &endDate, Natural fixingDays, const ext::shared_ptr< InterestRateIndex > &index, Real gearing=1.0, Spread spread=0.0, const Date &refPeriodStart=Date(), const Date &refPeriodEnd=Date(), DayCounter dayCounter=DayCounter(), bool isInArrears=false, const Date &exCouponDate=Date()) | |

| void | performCalculations () const override |

| Real | amount () const override |

| returns the amount of the cash flow | |

| Rate | rate () const override |

| accrued rate | |

| Real | price (const Handle< YieldTermStructure > &discountingCurve) const |

| DayCounter | dayCounter () const override |

| day counter for accrual calculation | |

| const ext::shared_ptr< InterestRateIndex > & | index () const |

| floating index | |

| Natural | fixingDays () const |

| fixing days | |

| Real | gearing () const |

| index gearing, i.e. multiplicative coefficient for the index | |

| Spread | spread () const |

| spread paid over the fixing of the underlying index | |

| virtual Rate | indexFixing () const |

| fixing of the underlying index | |

| virtual Rate | convexityAdjustment () const |

| convexity adjustment | |

| virtual Rate | adjustedFixing () const |

| convexity-adjusted fixing | |

| bool | isInArrears () const |

| whether or not the coupon fixes in arrears | |

| virtual void | setPricer (const ext::shared_ptr< FloatingRateCouponPricer > &) |

| ext::shared_ptr< FloatingRateCouponPricer > | pricer () const |

| Public Member Functions inherited from Coupon | |

| Coupon (const Date &paymentDate, Real nominal, const Date &accrualStartDate, const Date &accrualEndDate, const Date &refPeriodStart=Date(), const Date &refPeriodEnd=Date(), const Date &exCouponDate=Date()) | |

| Date | date () const override |

| Date | exCouponDate () const override |

| returns the date that the cash flow trades exCoupon | |

| virtual Real | nominal () const |

| const Date & | accrualStartDate () const |

| start of the accrual period | |

| const Date & | accrualEndDate () const |

| end of the accrual period | |

| const Date & | referencePeriodStart () const |

| start date of the reference period | |

| const Date & | referencePeriodEnd () const |

| end date of the reference period | |

| Time | accrualPeriod () const |

| accrual period as fraction of year | |

| Date::serial_type | accrualDays () const |

| accrual period in days | |

| Time | accruedPeriod (const Date &) const |

| accrued period as fraction of year at the given date | |

| Date::serial_type | accruedDays (const Date &) const |

| accrued days at the given date | |

| Public Member Functions inherited from CashFlow | |

| bool | hasOccurred (const Date &refDate=Date(), ext::optional< bool > includeRefDate=ext::nullopt) const override |

| returns true if an event has already occurred before a date | |

| bool | tradingExCoupon (const Date &refDate=Date()) const |

| returns true if the cashflow is trading ex-coupon on the refDate | |

| Public Member Functions inherited from Event | |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from LazyObject | |

| void | update () override |

| bool | isCalculated () const |

| void | setCalculated (bool c) const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

Additional Inherited Members | |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

| Rate | convexityAdjustmentImpl (Rate fixing) const |

| convexity adjustment for the given index fixing | |

| virtual void | calculate () const |

| ext::shared_ptr< InterestRateIndex > | index_ |

| DayCounter | dayCounter_ |

| Natural | fixingDays_ |

| Real | gearing_ |

| Spread | spread_ |

| bool | isInArrears_ |

| ext::shared_ptr< FloatingRateCouponPricer > | pricer_ |

| Real | rate_ |

| Date | paymentDate_ |

| Real | nominal_ |

| Date | accrualStartDate_ |

| Date | accrualEndDate_ |

| Date | refPeriodStart_ |

| Date | refPeriodEnd_ |

| Date | exCouponDate_ |

| Real | accrualPeriod_ |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

Detailed Description

overnight coupon

Coupon paying the interest, depending on the averaging convention, due to daily overnight fixings.

- Warning

- telescopicValueDates optimizes the schedule for calculation speed, but might fail to produce correct results if the coupon ages by more than a grace period of 7 days. It is therefore recommended not to set this flag to true unless you know exactly what you are doing. The intended use is rather by the OISRateHelper which is safe, since it reinitialises the instrument each time the evaluation date changes.

Member Function Documentation

◆ effectiveSpread()

| Real effectiveSpread | ( | ) | const |

effectiveSpread and effectiveIndexFixing are set such that coupon amount = notional * accrualPeriod * ( gearing * effectiveIndexFixing + effectiveSpread ) notice that

- gearing = 1 is required if compoundSpreadDaily = true

- effectiveSpread = spread() if compoundSpreadDaily = false

◆ fixingDate()

|

overridevirtual |

the date when the coupon is fully determined

Reimplemented from FloatingRateCoupon.

◆ accruedAmount()

accrued amount at the given date

Reimplemented from FloatingRateCoupon.

◆ accept()

|

overridevirtual |

Reimplemented from FloatingRateCoupon.

Generated by Doxygen 1.15.0