Swaption Class Reference

Swaption class More...

#include <ql/instruments/swaption.hpp>

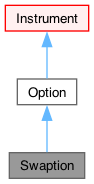

Inheritance diagram for Swaption:

Classes | |

| class | arguments |

| Arguments for swaption calculation More... | |

| class | engine |

| base class for swaption engines More... | |

Public Types | |

| enum | PriceType { Spot , Forward } |

| Public Types inherited from Option | |

| enum | Type { Put = -1 , Call = 1 } |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

Public Member Functions | |

| Swaption (ext::shared_ptr< FixedVsFloatingSwap > swap, const ext::shared_ptr< Exercise > &exercise, Settlement::Type delivery=Settlement::Physical, Settlement::Method settlementMethod=Settlement::PhysicalOTC) | |

Observer interface | |

| void | deepUpdate () override |

Instrument interface | |

| bool | isExpired () const override |

| returns whether the instrument might have value greater than zero. | |

| void | setupArguments (PricingEngine::arguments *) const override |

| Public Member Functions inherited from Option | |

| Option (ext::shared_ptr< Payoff > payoff, ext::shared_ptr< Exercise > exercise) | |

| ext::shared_ptr< Payoff > | payoff () const |

| ext::shared_ptr< Exercise > | exercise () const |

| Public Member Functions inherited from Instrument | |

| Real | NPV () const |

| returns the net present value of the instrument. | |

| Real | errorEstimate () const |

| returns the error estimate on the NPV when available. | |

| const Date & | valuationDate () const |

| returns the date the net present value refers to. | |

| const ext::shared_ptr< PricingEngine > & | pricingEngine () const |

| template<typename T> | |

| T | result (const std::string &tag) const |

| returns any additional result returned by the pricing engine. | |

| const std::map< std::string, ext::any > & | additionalResults () const |

| returns all additional result returned by the pricing engine. | |

| void | setPricingEngine (const ext::shared_ptr< PricingEngine > &) |

| set the pricing engine to be used. | |

| virtual void | fetchResults (const PricingEngine::results *) const |

| Public Member Functions inherited from LazyObject | |

| void | update () override |

| bool | isCalculated () const |

| void | setCalculated (bool c) const |

| void | forwardFirstNotificationOnly () |

| void | alwaysForwardNotifications () |

| void | recalculate () |

| void | freeze () |

| void | unfreeze () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

Inspectors | |

| Settlement::Type | settlementType () const |

| Settlement::Method | settlementMethod () const |

| Swap::Type | type () const |

| const ext::shared_ptr< FixedVsFloatingSwap > & | underlying () const |

| Volatility | impliedVolatility (Real price, const Handle< YieldTermStructure > &discountCurve, Volatility guess, Real accuracy=1.0e-4, Natural maxEvaluations=100, Volatility minVol=1.0e-7, Volatility maxVol=4.0, VolatilityType type=ShiftedLognormal, Real displacement=0.0, PriceType priceType=Spot) const |

| implied volatility | |

Additional Inherited Members | |

| Protected Member Functions inherited from Instrument | |

| void | calculate () const override |

| virtual void | setupExpired () const |

| void | performCalculations () const override |

| Protected Attributes inherited from Option | |

| ext::shared_ptr< Payoff > | payoff_ |

| ext::shared_ptr< Exercise > | exercise_ |

| Protected Attributes inherited from Instrument | |

| Real | NPV_ |

| Real | errorEstimate_ |

| Date | valuationDate_ |

| std::map< std::string, ext::any > | additionalResults_ |

| ext::shared_ptr< PricingEngine > | engine_ |

| bool | calculated_ = false |

| bool | frozen_ = false |

| bool | alwaysForward_ |

| Related Symbols inherited from Option | |

| std::ostream & | operator<< (std::ostream &, Option::Type) |

Detailed Description

Swaption class

- Warning

- it's possible to pass an overnight-indexed swap to the constructor, but the only engine to fully support it is BlackSwaptionEngine; other engines will treat it as a vanilla swap. This is at best a decent proxy, at worst simply wrong. Use with caution.

- Tests

- the correctness of the returned value is tested by checking that the price of a payer (resp. receiver) swaption decreases (resp. increases) with the strike.

- the correctness of the returned value is tested by checking that the price of a payer (resp. receiver) swaption increases (resp. decreases) with the spread.

- the correctness of the returned value is tested by checking it against that of a swaption on a swap with no spread and a correspondingly adjusted fixed rate.

- the correctness of the returned value is tested by checking it against a known good value.

- the correctness of the returned value of cash settled swaptions is tested by checking the modified annuity against a value calculated without using the Swaption class.

- Examples

- BermudanSwaption.cpp.

Member Function Documentation

◆ deepUpdate()

|

overridevirtual |

This method allows to explicitly update the instance itself and nested observers. If notifications are disabled a call to this method ensures an update of such nested observers. It should be implemented in derived classes whenever applicable

Reimplemented from Observer.

◆ isExpired()

|

overridevirtual |

returns whether the instrument might have value greater than zero.

Implements Instrument.

◆ setupArguments()

|

overridevirtual |

When a derived argument structure is defined for an instrument, this method should be overridden to fill it. This is mandatory in case a pricing engine is used.

Reimplemented from Option.

Generated by Doxygen 1.15.0