11.1 Binary Dependent Variables and the Linear Probability Model

Key Concept 11.1

The Linear Probability Model

The linear regression model

\[Y_i = \beta_0 + \beta_1 X_{1i} + \beta_2 X_{2i} + \dots + \beta_k X_{ki} + u_i\] with a binary dependent variable \(Y_i\) is called the linear probability model. In the linear probability model we have \[E(Y\vert X_1,X_2,\dots,X_k) = P(Y=1\vert X_1, X_2,\dots, X_3)\] where \[ P(Y = 1 \vert X_1, X_2, \dots, X_k) = \beta_0 + \beta_1 + X_1 + \beta_2 X_2 + \dots + \beta_k X_k.\]

Thus, \(\beta_j\) can be interpreted as the change in the probability that \(Y_i=1\), holding constant the other \(k-1\) regressors. Just as in common multiple regression, the \(\beta_j\) can be estimated using OLS and the robust standard error formulas can be used for hypothesis testing and computation of confidence intervals.

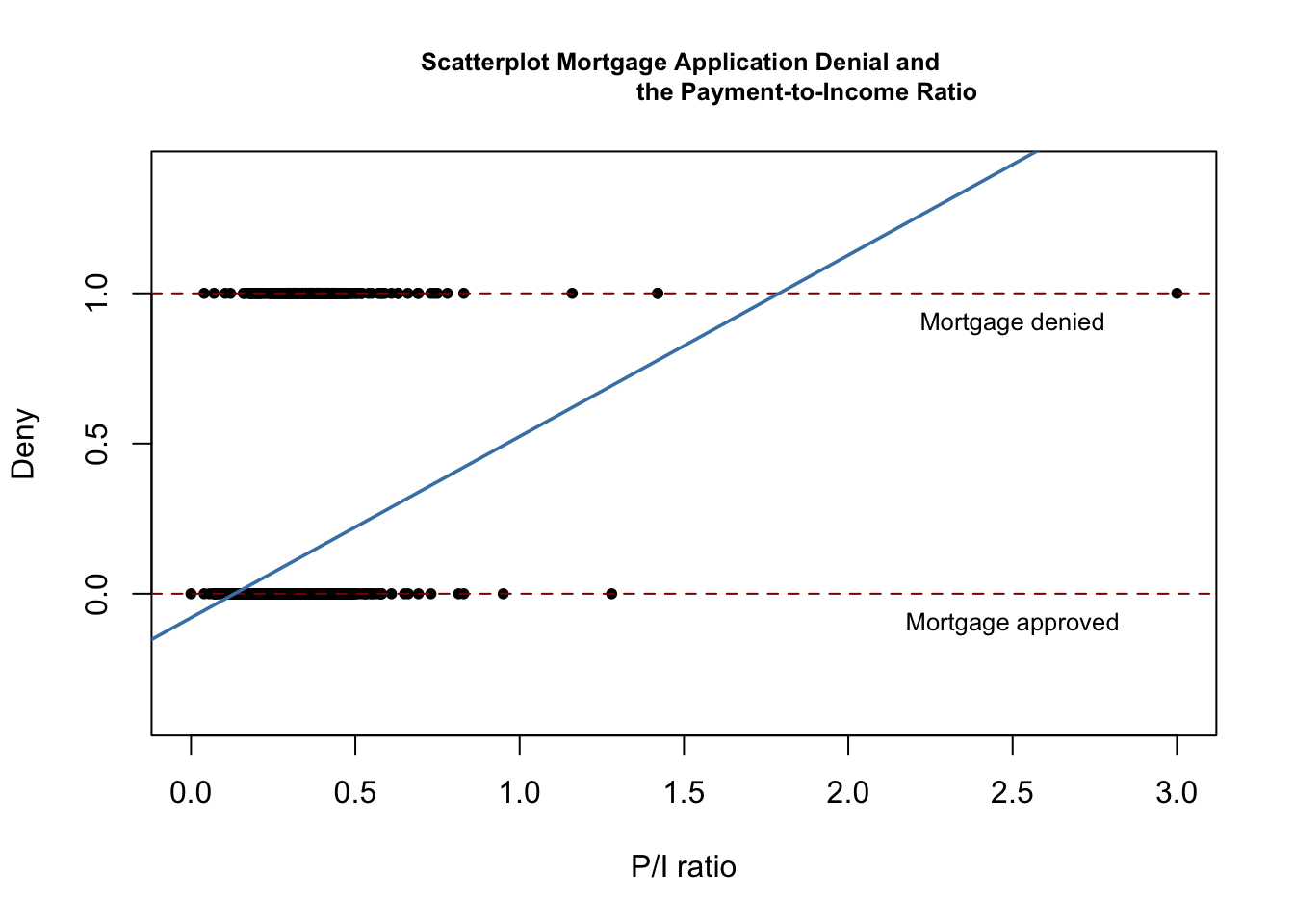

In most linear probability models, \(R^2\) has no meaningful interpretation since the regression line can never fit the data perfectly if the dependent variable is binary and the regressors are continuous. This can be seen in the application below.

It is essential to use robust standard errors since the \(u_i\) in a linear probability model are always heteroskedastic.

Linear probability models are easily estimated in R using the function lm().

Mortgage Data

Following the book, we start by loading the data set HMDA which provides data that relate to mortgage applications filed in Boston in the year of 1990.

We continue by inspecting the first few observations and compute summary statistics afterwards.

# inspect the data

head(HMDA)

#> deny pirat hirat lvrat chist mhist phist unemp selfemp insurance condomin

#> 1 no 0.221 0.221 0.8000000 5 2 no 3.9 no no no

#> 2 no 0.265 0.265 0.9218750 2 2 no 3.2 no no no

#> 3 no 0.372 0.248 0.9203980 1 2 no 3.2 no no no

#> 4 no 0.320 0.250 0.8604651 1 2 no 4.3 no no no

#> 5 no 0.360 0.350 0.6000000 1 1 no 3.2 no no no

#> 6 no 0.240 0.170 0.5105263 1 1 no 3.9 no no no

#> afam single hschool

#> 1 no no yes

#> 2 no yes yes

#> 3 no no yes

#> 4 no no yes

#> 5 no no yes

#> 6 no no yes

summary(HMDA)

#> deny pirat hirat lvrat chist

#> no :2095 Min. :0.0000 Min. :0.0000 Min. :0.0200 1:1353

#> yes: 285 1st Qu.:0.2800 1st Qu.:0.2140 1st Qu.:0.6527 2: 441

#> Median :0.3300 Median :0.2600 Median :0.7795 3: 126

#> Mean :0.3308 Mean :0.2553 Mean :0.7378 4: 77

#> 3rd Qu.:0.3700 3rd Qu.:0.2988 3rd Qu.:0.8685 5: 182

#> Max. :3.0000 Max. :3.0000 Max. :1.9500 6: 201

#> mhist phist unemp selfemp insurance condomin

#> 1: 747 no :2205 Min. : 1.800 no :2103 no :2332 no :1694

#> 2:1571 yes: 175 1st Qu.: 3.100 yes: 277 yes: 48 yes: 686

#> 3: 41 Median : 3.200

#> 4: 21 Mean : 3.774

#> 3rd Qu.: 3.900

#> Max. :10.600

#> afam single hschool

#> no :2041 no :1444 no : 39

#> yes: 339 yes: 936 yes:2341

#>

#>

#>

#> The variable we are interested in modelling is deny, an indicator for whether an applicant’s mortgage application has been accepted (deny = no) or denied (deny = yes). A regressor that ought to have power in explaining whether a mortgage application has been denied is pirat, the size of the anticipated total monthly loan payments relative to the the applicant’s income. It is straightforward to translate this into the simple regression model

\[\begin{align} deny = \beta_0 + \beta_1 \times P/I\ ratio + u. \tag{11.1} \end{align}\]

We estimate this model just as any other linear regression model using lm(). Before we do so, the variable deny must be converted to a numeric variable using as.numeric() as lm() does not accept the dependent variable to be of class factor. Note that as.numeric(HMDA$deny) will turn deny = no into deny = 1 and deny = yes into deny = 2, so using as.numeric(HMDA$deny)-1 we obtain the values 0 and 1.

# convert 'deny' to numeric

HMDA$deny <- as.numeric(HMDA$deny) - 1

# estimate a simple linear probabilty model

denymod1 <- lm(deny ~ pirat, data = HMDA)

denymod1

#>

#> Call:

#> lm(formula = deny ~ pirat, data = HMDA)

#>

#> Coefficients:

#> (Intercept) pirat

#> -0.07991 0.60353Next, we plot the data and the regression line to reproduce Figure 11.1 of the book.

# plot the data

plot(x = HMDA$pirat,

y = HMDA$deny,

main = "Scatterplot Mortgage Application Denial and

the Payment-to-Income Ratio",

xlab = "P/I ratio",

ylab = "Deny",

pch = 20,

ylim = c(-0.4, 1.4),

cex.main = 0.8)

# add horizontal dashed lines and text

abline(h = 1, lty = 2, col = "darkred")

abline(h = 0, lty = 2, col = "darkred")

text(2.5, 0.9, cex = 0.8, "Mortgage denied")

text(2.5, -0.1, cex= 0.8, "Mortgage approved")

# add the estimated regression line

abline(denymod1,

lwd = 1.8,

col = "steelblue")

According to the estimated model, a payment-to-income ratio of \(1\) is associated with an expected probability of mortgage application denial of roughly \(50\%\). The model indicates that there is a positive relation between the payment-to-income ratio and the probability of a denied mortgage application so individuals with a high ratio of loan payments to income are more likely to be rejected.

We may use coeftest() to obtain robust standard errors for both coefficient estimates.

# print robust coefficient summary

coeftest(denymod1, vcov. = vcovHC, type = "HC1")

#>

#> t test of coefficients:

#>

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -0.079910 0.031967 -2.4998 0.01249 *

#> pirat 0.603535 0.098483 6.1283 1.036e-09 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1The estimated regression line is \[\begin{align} \widehat{deny} = -\underset{(0.032)}{0.080} + \underset{(0.098)}{0.604} P/I \ ratio. \tag{11.2} \end{align}\] The true coefficient on \(P/I \ ratio\) is statistically different from \(0\) at the \(1\%\) level. Its estimate can be interpreted as follows: a 1 percentage point increase in \(P/I \ ratio\) leads to an increase in the probability of a loan denial by \(0.604 \cdot 0.01 = 0.00604 \approx 0.6\%\).

Following the book we augment the simple model (11.1) by an additional regressor \(black\) which equals \(1\) if the applicant is an African American and equals \(0\) otherwise. Such a specification is the baseline for investigating if there is racial discrimination in the mortgage market: if being black has a significant (positive) influence on the probability of a loan denial when we control for factors that allow for an objective assessment of an applicant’s creditworthiness, this is an indicator for discrimination.

# rename the variable 'afam' for consistency

colnames(HMDA)[colnames(HMDA) == "afam"] <- "black"

# estimate the model

denymod2 <- lm(deny ~ pirat + black, data = HMDA)

coeftest(denymod2, vcov. = vcovHC)

#>

#> t test of coefficients:

#>

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -0.090514 0.033430 -2.7076 0.006826 **

#> pirat 0.559195 0.103671 5.3939 7.575e-08 ***

#> blackyes 0.177428 0.025055 7.0815 1.871e-12 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1The estimated regression function is \[\begin{align} \widehat{deny} =& \, -\underset{(0.029)}{0.091} + \underset{(0.089)}{0.559} P/I \ ratio + \underset{(0.025)}{0.177} black. \tag{11.3} \end{align}\]

The coefficient on \(black\) is positive and significantly different from zero at the \(0.01\%\) level. The interpretation is that, holding the \(P/I \ ratio\) constant, being black increases the probability of a mortgage application denial by about \(17.7\%\). This finding is compatible with racial discrimination. However, it might be distorted by omitted variable bias so discrimination could be a premature conclusion.