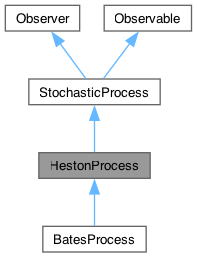

Square-root stochastic-volatility Heston process. More...

#include <ql/processes/hestonprocess.hpp>

Public Types | |

| enum | Discretization { PartialTruncation , FullTruncation , Reflection , NonCentralChiSquareVariance , QuadraticExponential , QuadraticExponentialMartingale , BroadieKayaExactSchemeLobatto , BroadieKayaExactSchemeLaguerre , BroadieKayaExactSchemeTrapezoidal } |

| Public Types inherited from Observer | |

| typedef set_type::iterator | iterator |

Public Member Functions | |

| HestonProcess (Handle< YieldTermStructure > riskFreeRate, Handle< YieldTermStructure > dividendYield, Handle< Quote > s0, Real v0, Real kappa, Real theta, Real sigma, Real rho, Discretization d=QuadraticExponentialMartingale) | |

| Size | size () const override |

| returns the number of dimensions of the stochastic process | |

| Size | factors () const override |

| returns the number of independent factors of the process | |

| Array | initialValues () const override |

| returns the initial values of the state variables | |

| Array | drift (Time t, const Array &x) const override |

| returns the drift part of the equation, i.e., \( \mu(t, \mathrm{x}_t) \) | |

| Matrix | diffusion (Time t, const Array &x) const override |

| returns the diffusion part of the equation, i.e. \( \sigma(t, \mathrm{x}_t) \) | |

| Array | apply (const Array &x0, const Array &dx) const override |

| Array | evolve (Time t0, const Array &x0, Time dt, const Array &dw) const override |

| Real | v0 () const |

| Real | rho () const |

| Real | kappa () const |

| Real | theta () const |

| Real | sigma () const |

| const Handle< Quote > & | s0 () const |

| const Handle< YieldTermStructure > & | dividendYield () const |

| const Handle< YieldTermStructure > & | riskFreeRate () const |

| Time | time (const Date &) const override |

| Real | pdf (Real x, Real v, Time t, Real eps=1e-3) const |

| Public Member Functions inherited from StochasticProcess | |

| virtual Array | expectation (Time t0, const Array &x0, Time dt) const |

| virtual Matrix | stdDeviation (Time t0, const Array &x0, Time dt) const |

| virtual Matrix | covariance (Time t0, const Array &x0, Time dt) const |

| void | update () override |

| Public Member Functions inherited from Observer | |

| Observer (const Observer &) | |

| Observer & | operator= (const Observer &) |

| std::pair< iterator, bool > | registerWith (const ext::shared_ptr< Observable > &) |

| void | registerWithObservables (const ext::shared_ptr< Observer > &) |

| Size | unregisterWith (const ext::shared_ptr< Observable > &) |

| void | unregisterWithAll () |

| virtual void | deepUpdate () |

| Public Member Functions inherited from Observable | |

| Observable (const Observable &) | |

| Observable & | operator= (const Observable &) |

| Observable (Observable &&)=delete | |

| Observable & | operator= (Observable &&)=delete |

| void | notifyObservers () |

Additional Inherited Members | |

| StochasticProcess (ext::shared_ptr< discretization >) | |

| ext::shared_ptr< discretization > | discretization_ |

Detailed Description

Square-root stochastic-volatility Heston process.

This class describes the square root stochastic volatility process governed by

\[\begin{array}{rcl} dS(t, S) &=& \mu S dt + \sqrt{v} S dW_1 \\ dv(t, S) &=& \kappa (\theta - v) dt + \sigma \sqrt{v} dW_2 \\ dW_1 dW_2 &=& \rho dt \end{array} \]

Member Function Documentation

◆ size()

|

overridevirtual |

returns the number of dimensions of the stochastic process

Implements StochasticProcess.

◆ factors()

|

overridevirtual |

returns the number of independent factors of the process

Reimplemented from StochasticProcess.

◆ initialValues()

|

overridevirtual |

returns the initial values of the state variables

Implements StochasticProcess.

◆ drift()

returns the drift part of the equation, i.e., \( \mu(t, \mathrm{x}_t) \)

Implements StochasticProcess.

◆ diffusion()

returns the diffusion part of the equation, i.e. \( \sigma(t, \mathrm{x}_t) \)

Implements StochasticProcess.

◆ apply()

applies a change to the asset value. By default, it returns \( \mathrm{x} + \Delta \mathrm{x} \).

Reimplemented from StochasticProcess.

◆ evolve()

returns the asset value after a time interval \( \Delta t \) according to the given discretization. By default, it returns

\[E(\mathrm{x}_0,t_0,\Delta t) + S(\mathrm{x}_0,t_0,\Delta t) \cdot \Delta \mathrm{w} \]

where \( E \) is the expectation and \( S \) the standard deviation.

Reimplemented from StochasticProcess.

◆ time()

returns the time value corresponding to the given date in the reference system of the stochastic process.

- Note

- As a number of processes might not need this functionality, a default implementation is given which raises an exception.

Reimplemented from StochasticProcess.

Generated by Doxygen 1.15.0