Magento 1.x Security Patch Notice

For Magento Open Source 1.5 to 1.9, Magento is providing software security patches through June 2020 to ensure those sites remain secure and compliant. Visit our information page for more details about our software maintenance policy and other considerations for your business.

VAT ID Validation

VAT ID Validation automatically calculates the required tax for B2B transactions that take place within the European Union (EU), based on the merchant and customer locale. Magento performs VAT ID validation using the web services of the European Commission server.

VAT-related tax rules do not influence other tax rules, and do not prevent the application of other tax rules. Only one tax rule can be applied at a given time.

- VAT is charged if the merchant and customer are located in the same EU country.

- VAT is not charged if the merchant and customer are located in different EU countries, and both parties are EU-registered business entities.

The store administrator creates more than one default customer group that can be automatically assigned to the customer during account creation, address creation or update, and checkout. The result is that different tax rules are used for intra-country (domestic) and intra-EU sales.

Important: If you sell virtual or downloadable products, which by their nature do not require shipping, the VAT rate of a customer’s location country should be used for both intra-union and domestic sales. You must create additional individual tax rules for product tax classes that correspond to the virtual products.

If VAT ID Validation is enabled, after registration each customer is prompted to enter the VAT ID number. However only those who are registered VAT customers are expected to complete the field.

After a customer specifies the VAT number and other address fields, and chooses to save, the system saves the address and sends the VAT ID validation request to the European Commission server. According to the results of the validation, one of the default groups is assigned to a customer. This group can be changed if a customer or an administrator changes the VAT ID of the default address, or changes the entire default address. In some cases, the group is temporarily changed during checkout by emulating a group change.

If a customer’s VAT validation is performed during checkout, the VAT request identifier and VAT request date are saved in the Comments History section of the order.

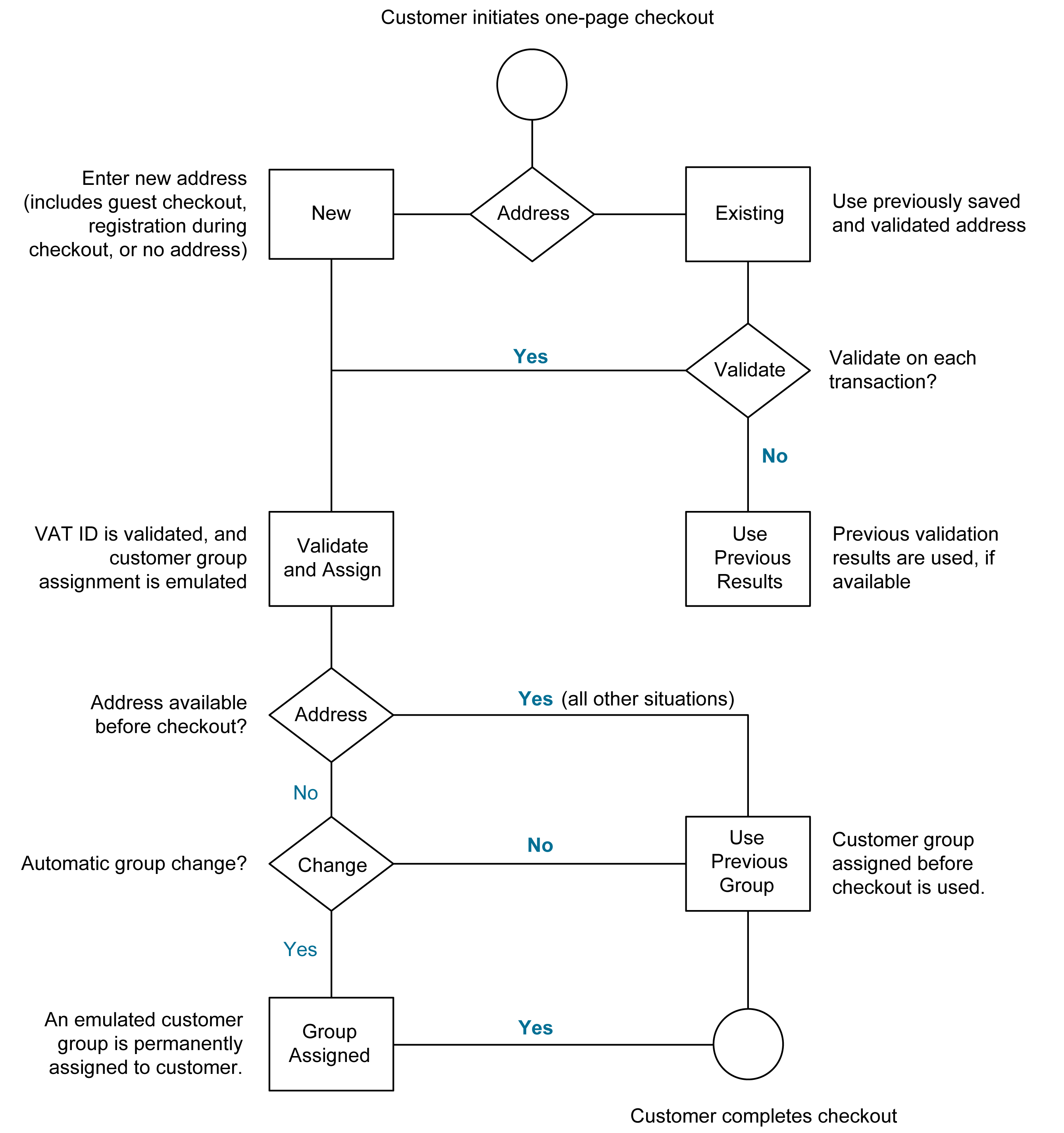

The system behavior of the VAT ID validation and the customer group change during the checkout depends on how the Validate on Each Transaction and the Disable Automatic Group Change settings are configured. If a customer uses PayPal Express Checkout, Google Express Checkout, or another external checkout method that uses an external payment gateway, the Validate on Each Transaction setting cannot be applied. Thus the customer group cannot be changed during checkout.

“One-Page” Checkout with VAT ID Validation