Magento 1.x Security Patch Notice

For Magento Open Source 1.5 to 1.9, Magento is providing software security patches through June 2020 to ensure those sites remain secure and compliant. Visit our information page for more details about our software maintenance policy and other considerations for your business.

Tax Rules

Tax rules put all the taxation elements together: product tax classes, customer tax classes, and tax zones and rates. Each tax rule consists of a customer tax class, a product tax class, and a tax rate.

When numerous taxes must be defined, you can simplify the process by importing them from a spreadsheet. Select Sales > Tax > Import/Export Tax Rates.

To define tax rules:

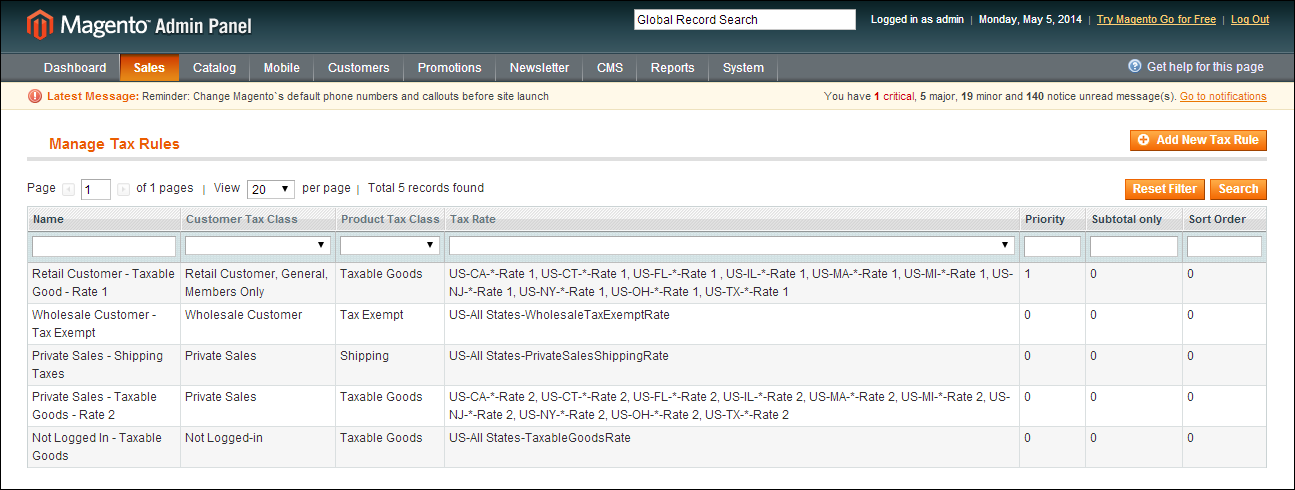

| 1. | On the Admin menu, select Sales > Tax > Manage Tax Rules. |

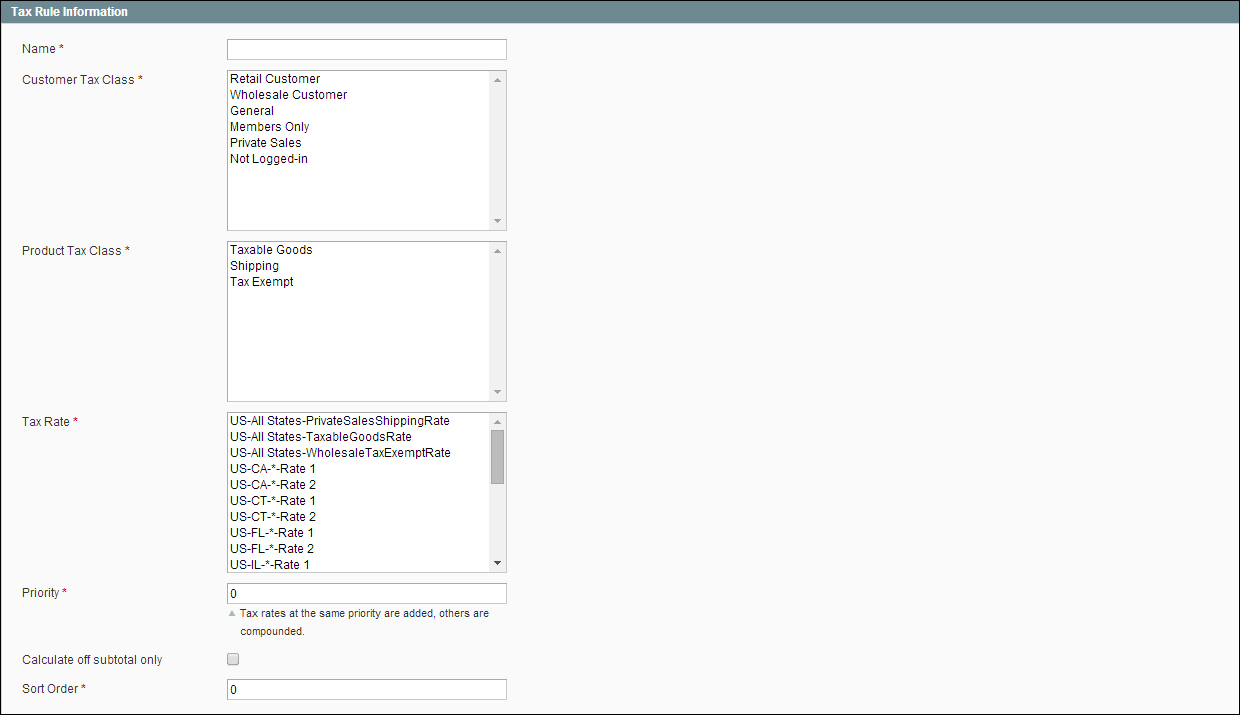

| 2. | In the upper-right corner, click the Add New Tax Rule button. Then, do the following: |

| a. | Enter a Name for the rule. |

| b. | Select a Customer Tax Class. To select multiple options, hold the Ctrl key down and click each item. |

| c. | Select a Product Tax Class. |

| d. | Select the Tax Rate. |

This rule applies the tax rate to customers in the selected customer tax class and to products in the selected product tax class.

| e. | In the Priority field, enter a number to indicate the priority of this tax, when more than one tax applies. If two tax rules with the same priority apply, then the taxes are added together. If two taxes with different priority settings apply, then the taxes are compounded. |

| 3. | In the Sort Order field, enter a number to indicate the order in which tax rules are displayed on the Manage Tax Rules page. |

| 4. | If you want taxes to be based on the order subtotal, select the Calculate off Subtotal Only checkbox. |

| 5. | When complete, click the Save Rule button. |

-

Field Descriptions Field

Description

Name

Enter a name for this tax rule to make it easy to identify.

Customer Tax Class

Select the customer tax class associated with this rule.

Product Tax Class

Select the product tax class associated with this rule.

Tax Rate

Select the tax rate that applies to this rule.

Priority

Enter a number to indicate the priority of this tax, when more than one tax applies. Lower numbers have higher priority. If two tax rules with the same priority apply then the taxes are added together. If two taxes with a different priority apply then the taxes are compounded. When taxes are compounded, the first priority tax is calculated on the subtotal amount, and then the second priority tax is calculated on the subtotal plus the first priority tax amount.

Calculate off Subtotal Only

Select this checkbox for taxes to be calculated based on the subtotal of the order. This means that for this tax rule, tax applies only to the subtotal of the order.

Sort Order

Specify the order in which tax rules are displayed on the Manage Tax Rules page. Lower numbers have higher sort order in the list.