Magento Open Source, 1.9.x

Cross-Border Price Consistency

Cross-border trade (also referred to as price consistency) supports European Union (EU) and other merchants who want to maintain consistent prices for customers whose tax rates are different than the store tax rate.

Merchants operating across regions and geographies can show their customers a single price. Pricing is clean and uncluttered regardless of tax structures and rates that vary from country to country.

To use cross-border price consistency, your store must include tax in product prices.

To enable cross-border price consistency:

| 1. | On the Admin menu, select System > Configuration. Then in the panel on the left, under Sales, select Tax. |

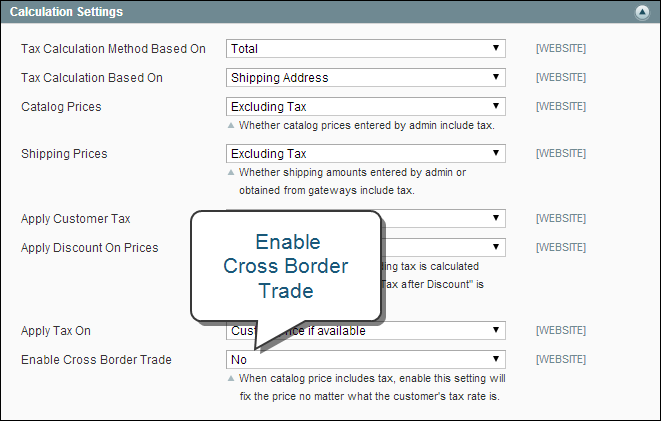

| 2. | Click to expand the Calculation Settings section. |

| 3. | To enable cross-border price consistency, set Enable Cross Border Trade to “Yes.” |

Important! If you enable cross-border trade your profit margin changes by tax rate. Profit is determined by the formula: (Revenue - CustomerVAT - CostOfGoodsSold)

| 4. | When complete, click the Save Config button. |