Magento 1.x Security Patch Notice

For Magento Open Source 1.5 to 1.9, Magento is providing software security patches through June 2020 to ensure those sites remain secure and compliant. Visit our information page for more details about our software maintenance policy and other considerations for your business.

Tax

System > Configuration > Sales > Tax

-

Field Descriptions Field

Description

Tax Class for Shipping

Website

Identifies the tax class that is used for shipping. Options include all available product tax classes:

None

Taxable Goods

Shipping

Tax Exempt

Tax Class for Gift Options

Website

Identifies the tax class that is used for gift options. Options include all available product tax classes:

None

Taxable Goods

Shipping

Tax Exempt

-

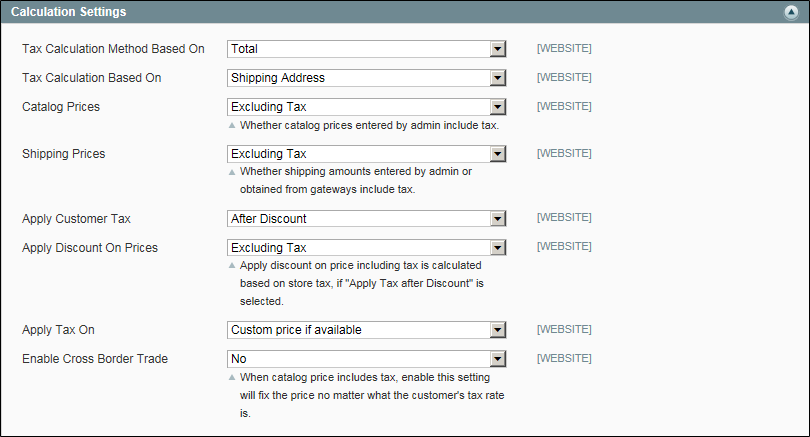

Field Descriptions Field

Description

Tax Calculation Method Based On

Website

Determines whether the tax is based on the unit price of the product, line item total, accounting for any discounts, or total. Options:

Unit Price

Row Total

Total

Tax Calculation Based On

Website

Determines if the tax calculation is based on the shipping address, billing address, or the shipping origin. Options:

Shipping Address

Billing Address

Shipping Origin

Catalog Prices

Website

Determines if catalog prices include or exclude tax. Options:

Excluding Tax

Including Tax

Shipping Prices

Website

Determines in shipping prices include or exclude tax. Options:

Excluding Tax

Including Tax

Apply Customer Tax

Website

Determines if tax is applied before, or after a discount. Options:

Before Discount

After Discount

Apply Discount on Prices

Website

Determines if discount prices include or exclude tax. Options:

Excluding Tax

Including Tax

Apply Tax On

Website

Determines if the tax applies to the original price, or to a custom price, if available. Options:

Custom price if available

Original price only

Enable Cross Border Trade

Website

When enabled, applies consistent pricing across borders of regions with different tax rates. Options: Yes / No

Using cross-border trade adjusts the profit margin by tax rate.

-

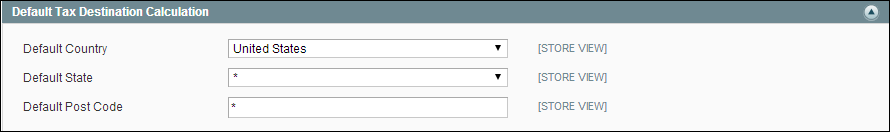

Field Descriptions Field

Description

Default Country

Store View

Determines the country upon which tax calculations are based. Options: All countries

Default State

Store View

Determines the state upon which tax calculations are based. An asterisk (*) can be used as a wildcard to indicate all states within the selected country. Options include: All states in selected country

Default Post Code

Store View

Identifies the postal code or ZIP code upon which tax calculations are based. An asterisk (*) can be used as a wildcard to indicate all postal codes within the selected state.

-

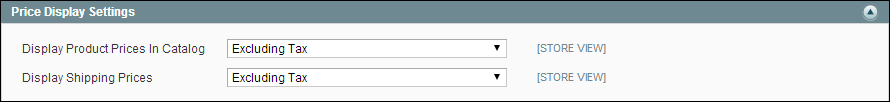

Field Descriptions Field

Description

Display Product Prices in Catalog

Store View

Determines if product prices published in the catalog include or exclude tax, or show two versions of the price; one with, and the other without tax.

Options include:

Excluding Tax

Including Tax

Including and Excluding Tax

If you set the Display Product Prices field to “Including Tax,” the tax appears only if there is a tax rule that matches the tax origin, or if there is a customer address that matches the tax rule. Events that can trigger a match include customer account creation, login, or the use of the Tax and Shipping estimation tool in the shopping cart.

Display Shipping Prices

Store View

Determines if shipping prices include or exclude tax, or show two versions of the shipping price; one with, and the other without tax. Options:

Excluding Tax

Including Tax

Including and Excluding Tax

-

Field Descriptions Field

Description

Display Prices

Store View

Determines if shopping cart prices include or exclude tax, or show two versions of the price; one with, and the other without tax. Options:

Excluding Tax

Including Tax

Including and Excluding Tax

Display Subtotal

Store View

Determines if the shopping cart subtotal includes or excludes tax, or shows two versions of the subtotal; one with, and the other without tax. Options:

Excluding Tax

Including Tax

Including and Excluding Tax

Display Shipping Amount

Store View

Determines if the shopping cart shipping amount includes or excludes tax, or shows two versions of the shipping amount; one with, and the other without tax. Options:

Excluding Tax

Including Tax

Including and Excluding Tax

Include Tax in Grand Total

Store View

Determines if tax is included in the shopping cart grand total. Options: Yes / No

Display Full Tax Summary

Store View

Determines if the shopping cart includes a full tax summary. Options: Yes / No

Display Zero Tax Subtotal

Store View

Determines if the shopping cart includes a tax subtotal when the tax is zero. Options: Yes / No

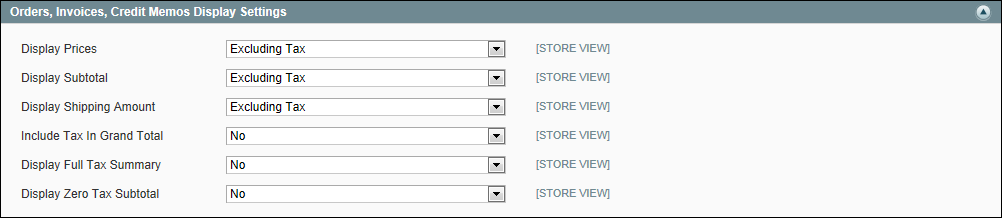

-

Field Descriptions Field

Description

Display Prices

Store View

Determines if the prices on sales documents include or exclude tax, or if each document shows two versions of the price; one with, and the other without tax. Options:

Excluding Tax

Including Tax

Including and Excluding Tax

Display Subtotal

Store View

Determines if the subtotal on sales documents includes or excludes tax, or if each document shows two versions of the subtotal; one with, and the other without tax. Options:

Excluding Tax

Including Tax

Including and Excluding Tax

Display Shipping Amount

Store View

Determines if the shipping amount on sales documents includes or excludes tax, or if each document shows two versions of the subtotal; one with, and the other without tax.Options:

Excluding Tax

Including Tax

Including and Excluding Tax

Include Tax in Grand Total

Store View

Determines if the grand total on sales documents includes tax. Options: Yes / No

Display Full Tax Summary

Store View

Determines if the full tax summary appears on sales documents. Options: Yes / No

Display Zero Tax Subtotal

Store View

Determines of the subtotal section on sales documents appears when no tax is charged. Options: Yes / No