The following example depicts a store based in France that sells > 100k Euros in France and > 100k Euros in Germany.

- Tax calculations are managed at the website level.

- Currency conversion and tax display options are controlled individually at the store view level, (Click the Use Website checkbox to override the default).

- By setting the default tax country you can dynamically show the correct tax for the jurisdiction.

- Fixed product tax is included for relevant goods as a product attribute.

- It might be necessary to edit the catalog to ensure that it shows up in the correct category/website/store view.

Create the following tax rates:

-

Tax Rates Tax Rate

Setting

France-StandardVAT

Country:

France

State/Region:

*

ZIP/Postal Code:

*

Rate:

20%

France-ReducedVAT

Country:

France

State/Region:

*

ZIP/Postal Code:

*

Rate:

5%

Germany-StandardVAT

Country:

Germany

State/Region:

*

ZIP/Postal Code:

*

Rate:

19%

Germany-ReducedVAT

Country:

Germany

State/Region:

*

ZIP/Postal Code:

*

Rate:

7%

Create the following tax rules:

-

Tax Rules Tax RULE

Setting

Retail-France-StandardVAT

Customer Class:

Retail Customer

Tax Class:

VAT-Standard

Tax Rate:

France-StandardVAT

Priority:

0

Sort Order:

0

Retail-France-ReducedVAT

Customer Class:

Retail Customer

Tax Class:

VAT Reduced

Tax Rate:

France-ReducedVAT

Priority:

0

Sort Order:

0

Retail-Germany-StandardVAT

Customer Class:

Retail Customer

Tax Class:

VAT-Standard

Tax Rate:

Germany-StandardVAT

Priority:

0

Sort Order:

0

Retail-Germany-ReducedVAT

Customer Class:

Retail Customer

Tax Class:

VAT-Reduced

Tax Rate:

Germany-ReducedVAT

Priority:

0

Sort Order:

0

| 1. | In the upper-left corner of the Admin, click the Manage Stores link. |

| 2. | Under the default website, create a store view for Germany. Then, do the following: |

| a. | On the Admin menu, select System > Configuration. In the upper-left corner, set Default Config to the French store. |

| b. | On the General page, click to expand the Countries Options section, and set the default country to “France.” |

| c. | Complete the locale options as needed. |

| 3. | In the upper-left corner, set Current Configuration Scope to the German website. Then, do the folloiwng: |

| a. | On the General page, click to expand Countries Options, and set the default country to “Germany.” |

| b. | Complete the locale options as needed. |

Complete the following General tax settings:

-

General Settings Field

Recommended Setting

Tax Classes

Tax Class for Shipping

Shipping (shipping is taxed)

Calculation Settings

Tax Calculation Method Based On

Total

Tax Calculation Based On

Shipping Address

Catalog Prices

Including Tax

Shipping Prices

Including Tax

Apply Customer Tax

After Discount

Apply Discount on Prices

Including Tax

Apply Tax On

Custom Price (if available)

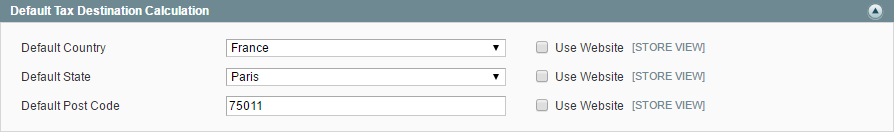

Default Tax Destination Calculation

Default Country

France

Default State

Default Postal Code

* (asterisk)

Shopping Cart Display SEttings

Include Tax in Grand Total

Yes

Fixed Product taxes

Enable FPT

Yes

All FPT Display Settings

Including FPT and FPT description

Apply Discounts to FPT

No

Apply Tax to FPT

Yes

Include FPT in Subtotal

Yes

| 1. | On the Admin menu, select System > Configuration. |

| 2. | In the upper-right corner, set Current Configuration Scope to the German store. |

| 3. | In the panel on the left, under Sales, select Tax. Then, expand the Default Tax Destination Calculation section. |

| 4. | Clear the Use Website checkbox after each field. Then, update the values to match the site's Shipping Settings point of origin. |

- Default Country

- Default State

- Default Post Code

| 5. | When complete, click the Save Config button to save the settings. |